Top 10 Best AI Stock Trading Bots

AI trading bots can make trading decisions based on algorithms. Each AI trading bot uses a customized algorithm to interpret data and perform transactions.

I was searching for how AI trading bots can give me good returns. Most broker sites said that I could win big time if I used AI bots for trading. However, many fin corps also warned that I could lose big-time.

But the potential of AI bot trading and its wide acceptance is undeniable. At least 30% of investors in the US happily allow an AI trader bot to make trading decisions on their behalf.

Overview Of How AI And Machine Learning Improve Trading Processes

AI and ML can play a profitable role in enhancing trade results. For instance, ML’s calculating algorithms and AI’s use of intellect can be combined. The combined algorithm can suggest feasible future market trends.

You can also use the combined algorithm to identify the potential risks and opportunities.

Types of AI Trading Bots

We learned that AI trading bots can revolutionize the market. It can offer undaunting returns.

Now, we come across many AI trading bots every day. Many new bots are emerging as well. Let’s find out the best AI bots for trading.

1. Trade Ideas

Let’s see how Trade Ideas help our trading regime. We will also evaluate its operating methodology.

Features

Trade Ideas’ server is built by a team of core US developers. They connected their servers directly with the Exchange markets. Therefore, they can watch every movement in the markets in real time. The AI bots can also evaluate the current movements against pat records in real time.

There are almost 12 AI algorithms that can funnel and process each other’s data.

Why does it matter to investors?

It helps investors with suggestions for real-time improvements. At the same time, it recommends the best trading options for processing all this data together.

However, the prime benefit is that these happen in real time.

Target Audience

It targets a broad span of users with variable investing interests. However, it is best for those who depend on technical analysis for investing. I mean those who invest for short-term gains only.

Customization Options

It is mainly a ranking bot. It uses real-time data from the market to pre-calculate and create a non-exhaustive ranking of the best options for you.

You can use prompts to make the bot understand your trading priorities.

2. TrendSpider

Let’s find out the benefits of the advanced automated technical analysis of TrendSpider.

Automatic Technical Analysis

The automatic analysis algorithm can scan historical markets to detect where the forex arrow is heading.

Trading Bot Capabilities

TrendSpider has a unique feature. It has a community of avid traders. The ai trading bot allows them to start a trend line.

But how do you do so?

Let’s imagine you are a regular user of the TrendSpider app.

You calculated a trend or strategy and used it for your trading. When you see that the conditions comply with the plan, you can mark it as an event.

Platform Features

It is one of the most customizable and flexible AI trading apps. It helps day traders and growth stock owners alike.

3. Signm

Signm’s rapid interpretation of market trends is based on social news as well as financial analysis. So, it does not rest its analysis on server data from the exchange markets only.

Market Trend Analysis

In real-time, Signm’s AI algorithm can accommodate a dataset of 2 million individual opinions from the stock market.

So, what’s the big deal?

As a user, you remain updated with the latest market analysis trends. Otherwise, you would have to do the same for the best returns from the market.

Wait! Signm can do more.

It can also analyze 1500 news articles daily. At the same time, Signm can process data from 50 sources of financial news.

Therefore, I feel that Signm can make the right mix of automated fundamental and technical analysis.

Sentiment Analysis for Better Decision-making

On the one hand, you can source the best analysis of the organizational health of your most sought-after stocks. On the other hand, you can always access accurate time analysis of instantaneous exchange market data.

Analysis Of Other Best AI Trading Bots

In the previous discussion, we have come across the best features that an AI trading bot can offer. Now, let’s have a look at other competent AI trading bots and what they have to offer.

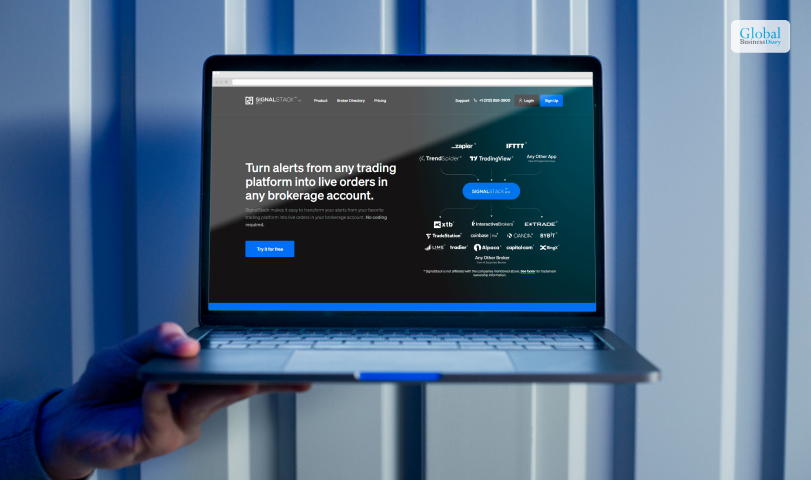

Signal Stack

Signal Stack can send real-time signals in the form of notifications. You can customize your trading decisions based on these updates. Hence, it is a good AI trading bot for trading portfolio management.

The best features of Signal Stack are:

- Advanced AI algorithms

- Better scope of portfolio management, using leads from Signal Stack

- Comfortable risk management

What’s best about the app?

It’s highly automated. Its backtesting abilities are also phenomenal.

However, there are a lot of technical complexities that first-time traders may not understand easily.

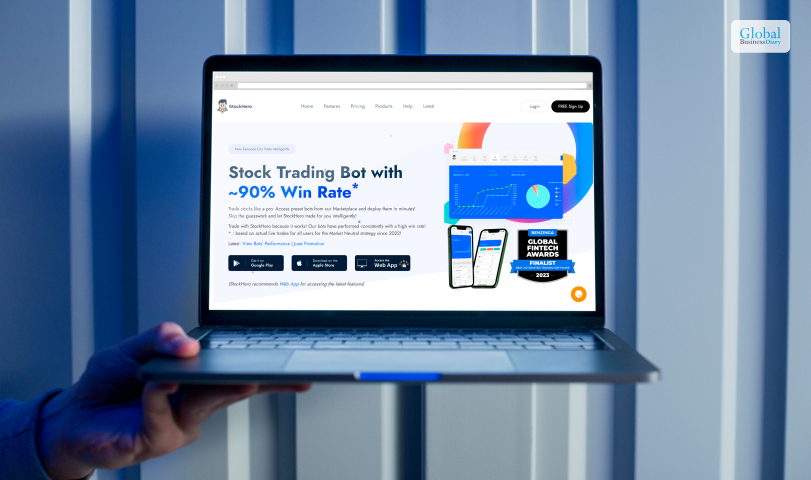

Stock Hero

It is a dedicated stock-screening AI trading bot.

However, the best part of Stock Hero is that it can quickly identify undervalued stocks. As a bonus, it tracks fast. So, you can invest in undervalued stocks when stock prices are low.

The best features of Stock Hero are:

- Easier for portfolio management

- Real-time analysis before others

I found that the AI trading bot is efficient in tracking stocks. However, its analysis relies more on the market attributes (trends).

Holly AI

This AI trading bot uses 70 unique algorithms to interpret more than 8000 stocks from the US market daily. Holly AI apparently performs millions of backtests daily.

You get the best scope of data-supported trading here.

Holly’s new app- Holly 2.0, tracks and scans day trading scenarios more avidly.

The best features that Holly AI offers:

- The backtest win rate is more than 60%

- It has a 2:1 risk-reward ratio

However, you will have difficulty understanding the app’s complexities if you are not an avid trader.

TradingView

It allows US traders to make comprehensive investments in international stocks. FX and cryptocurrency trading suggestions are also available here.

For better trading results, this AI trader bot uses:

- Chart pattern detection

- Candlestick pattern detector

Whether it’s Harami, Marubozu, or Doji, this ai trading bot can detect and interpret any bullish or bearish pattern.

So, you get a versatile range of trading strategies to ponder upon.

Cryptohopper

This AI trading bot is most suitable for trading cryptos. Like other efficient apps, CryptoHopper’s algorithm offers fully automated trading options.

The app also offers portfolio management services free of cost. However, I like its trailing feature more. You can automate the process of selling/buying when the graph goes astray.

Weinner AI

I found no two user-friendly AI trading bots like this one. So, Weinner AI is compatible with beginners in trading, too. Unlike many others, Weinner AI combines AI with crypto stocks to help you find the best investment options.

What’s best about the app?

You can do token swaps with Weinner AI.

So you can swap your tokens seamlessly. As a result, you can opt for the best prices on the DEXs.

Perceptrader AI

This AI trading bot is most compatible with helping users discover the ideal entry and exit points. So, this app is popular as the best model for price prediction.

But what’s best about the app?

It follows the customized system of grid trading. So, you can easily buy or sell any order at prefixed time slots.

Conclusion

Are you using an AI trading bot for your trading decisions? Then you ought to enjoy these benefits. Firstly, you could learn to adapt to market changes faster. Secondly, you are now able to make data-oriented decisions in real-time. AI trading bot can analyze paramount market data in seconds. There’s no doubt about that. However, the kind of market leads and trend news available from these bots are unparalleled.

For More Business Related Articles, Click Below!!