IPOE Stock – Present Price, Forecast, Statistics – Should You Invest In It In 2022?

In case you have invested in IPOE stock and looking for its best review, you have arrived at the right place.

In this guide, I will be answering whether IPOE stock is worthy of investment in 2022. Through a step-by-step analytical process, I have extracted the final answer by conducting proper research.

So stay tuned with us and keep reading till the end.

IPOE Stock – The Origin

IPOE Stock is issued by Social Capital Hedosophia Corp CI A (IPOE), a financial services company that is a next-generation leader. It’s a publicly listed acquisition business with a unique purpose.

They completed their previously announced deal on May 28, 2021, and brought SoFi public. SoFi technologies, INC, a publicly listed consumer-focused financial technology platform, was founded as a result of this deal

Current Price Of IPOE Stock

At present, that is on April 18th, 2022, the price of IPOE stock is $22.010 USD.

Prediction Of IPOE Stock Price

Below, a prediction of IPOE Stock has been put forward for better accuracy while giving the verdict. I have taken into consideration both the historical and forecast data. Take a look:

1. Historical Data

| Date | Opening price | Closing price | Minimum price | Maximum price |

| 2022-04-14 | Open: 0.510 | Close: 0.580 | Low: 0.470 | High: 0.580 |

| 2022-04-13 | Open: 0.5075 | Close: 0.550 | Low: 0.465 | High: 0.550 |

| 2022-04-12 | Open: 0.5010 | Close: 0.550 | Low: 0.5010 | High: 0.550 |

| 2022-04-11 | Open: 0.510 | Close: 0.510 | Low: 0.510 | High: 0.620 |

| 2022-04-08 | Open: 0.452 | Close: 0.452 | Low: 0.452 | High: 0.570 |

| 2022-04-07 | Open: 0.550 | Close: 0.538 | Low: 0.529 | High: 0.550 |

| 2022-04-06 | Open: 0.540 | Close: 0.550 | Low: 0.490 | High: 0.550 |

| 2022-04-05 | Open: 0.450 | Close: 0.490 | Low: 0.450 | High: 0.530 |

| 2022-04-04 | Open: 0.570 | Close: 0.577 | Low: 0.550 | High: 0.577 |

| 2022-04-01 | Open: 0.460 | Close: 0.460 | Low: 0.460 | High: 0.460 |

| 2022-03-31 | Open: 0.450 | Close: 0.450 | Low: 0.450 | High: 0.450 |

| 2022-03-30 | Open: 0.450 | Close: 0.450 | Low: 0.450 | High: 0.450 |

| 2022-03-29 | Open: 0.450 | Close: 0.465 | Low: 0.450 | High: 0.480 |

| 2022-03-28 | Open: 0.451 | Close: 0.480 | Low: 0.451 | High: 0.481 |

Analysis: The historical IPOE Stock price demonstrated above indicates that from 28th March to 14th April, the IPOE stock price has got an increasing trend. This rising trend is observable in opening price, closing price, maximum and minimum prices.

2. Predicted Future Data

| May 2022 | Open: 30.021 | Close: 31.466 | Min: 30.021 | Max: 31.645 | Change: 4.59 % ▲ |

| June 2022 | Open: 31.296 | Close: 32.150 | Min: 30.960 | Max: 32.396 | Change: 2.65 % ▲ |

| July 2022 | Open: 32.584 | Close: 33.335 | Min: 31.711 | Max: 33.335 | Change: 2.25 % ▲ |

| August 2022 | Open: 32.462 | Close: 33.737 | Min: 32.462 | Max: 34.086 | Change: 3.78 % ▲ |

| September 2022 | Open: 33.840 | Close: 35.025 | Min: 33.401 | Max: 35.025 | Change: 3.38 % ▲ |

| October 2022 | Open: 34.152 | Close: 34.903 | Min: 34.152 | Max: 35.776 | Change: 2.15 % ▲ |

| November 2022 | Open: 35.597 | Close: 36.178 | Min: 35.091 | Max: 36.527 | Change: 1.61 % ▲ |

| December 2022 | Open: 36.281 | Close: 37.466 | Min: 35.842 | Max: 37.466 | Change: 3.16 % ▲ |

Analysis: The IPOE stock forecast data above denotes a rise in price from May 2022 to December 2022. This rising trend is observable in all the opening, closing, minimum and maximum prices.

52 Week High And Low Of IPOE Stock Price

Here are the 52-week high and low values of IPOE Stock in 2022. I have bifurcated the data into two parts – Historical and forecast data.

1. Historical Data

| 52 Week High | 52 Week Low |

| 21.8 | 14.14 |

2. Predicted Future Data

| 52 Week High | 52 Week Low |

| 31.645 | 21.007 |

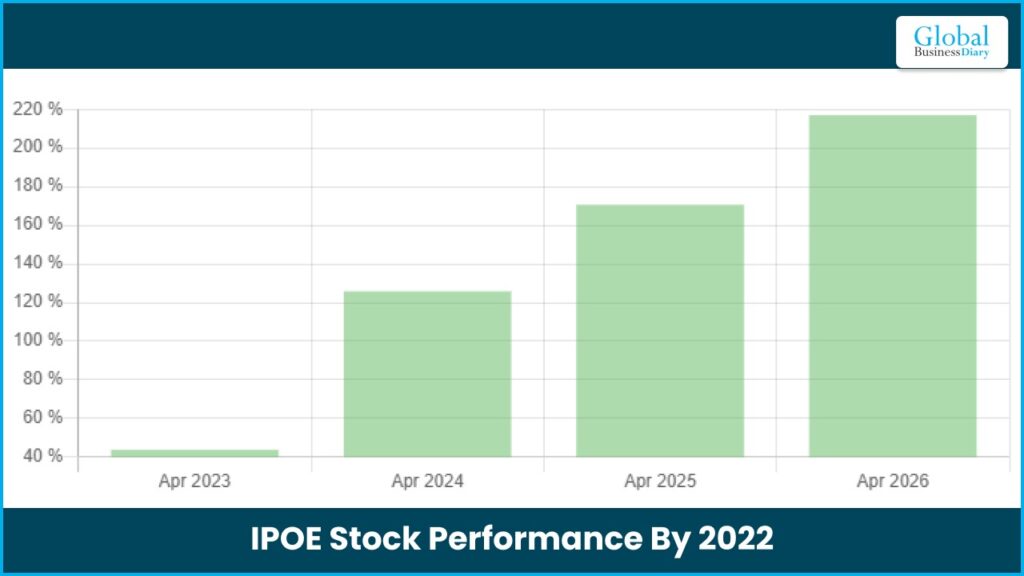

IPOE Stock Performance By 2022

Analysis: As you can see in the graph above, the 4-year IPOE stock forecast is explained. From April 2023 to April 2026, a sharp upward rising trend is noticeable in IPOE stock price. So, it’s evident that it’s worthy of investment in 2022.

IPOE Stock Performance By 2023

| January 2023 | 36.593 | 38.038 | 36.593 | 38.217 | 3.8 % ▲ |

| February 2023 | 37.868 | 38.789 | 37.532 | 38.968 | 2.37 % ▲ |

| March 2023 | 38.619 | 39.907 | 38.283 | 39.907 | 3.23 % ▲ |

| April 2023 | 39.034 | 40.658 | 39.034 | 40.658 | 3.99 % ▲ |

| May 2023 | 39.785 | 41.061 | 39.785 | 41.409 | 3.11 % ▲ |

| June 2023 | 41.163 | 42.348 | 40.724 | 42.348 | 2.8 % ▲ |

| July 2023 | 41.475 | 42.227 | 41.475 | 43.099 | 1.78 % ▲ |

| August 2023 | 42.920 | 43.604 | 42.414 | 43.850 | 1.57 % ▲ |

| September 2023 | 44.038 | 44.789 | 43.166 | 44.789 | 1.68 % ▲ |

| October 2023 | 43.917 | 45.361 | 43.917 | 45.540 | 3.19 % ▲ |

| November 2023 | 45.192 | 46.045 | 44.856 | 46.292 | 1.85 % ▲ |

| December 2023 | 46.479 | 47.231 | 45.607 | 47.231 | 1.59 % ▲ |

Analysis: For the coming year, that is 2023, the IPOE stock price would rise from January 2023 to December 20223. The changes highlighted in the extreme right column are all positive which is quite impressive.

Frequently Asked Questions (FAQs)

The IPOE Stock Price today is $22.010 USD.

Yes. In a year, the IPOE stock price might rise from 22.010 USD to 31.645 USD.

Yes. In a single year, the long-term earning potential is +43.77 percent.

According to the IPOE Stock Forecast, the future price will be 70.355 USD.

As per IPOE Stock forecast 2025, the prices will remain positive along with an increasing trend.

Should You Invest In IPOE Stock In 2022?

To summarise, IPOE stock appears to be a viable investment opportunity in 2022. It’s mostly due to the long-term earning potential of +43.77 percent in a single year, as well as the possibility for profitability. However, because this business is so volatile, make sure you follow every change, volatility, highs, lows, and statistic.

See you in the comment section.

Disclaimer: Respected Readers, the IPOE Stock price facts, and the data we presented above are all assumptions. All the data refers to those present on the leading cryptomarket websites. The actual values might be different on the basis of the market situation. Please note that share/stock prices are subject to market risks. Read all the documents and examine them carefully before investing.

Also Read: