What Is The Leverage Ratio And How to Calculate It?

Leverage ratio is a tool for businesses that helps to determine the extent to which a particular business depends on debt to purchase assets and build capital. On the one hand, it helps businesses determine their own capability to secure funding. On the other hand, the leverage ratio helps investors and lenders evaluate the ability of a business to meet its financial obligations after securing capital.

In this article, you will learn about leverage ratio in general and how it works for businesses as well as investors and lenders alike. We will also share with you details on how to calculate the leverage ratio formula of different types of leverage ratios. Finally, you will learn about the importance of the leverage ratio and how it applies to businesses. Hence, to learn more, read on through to the end of the article.

What Is The Leverage Ratio?

According to Investopedia,

“A leverage ratio is any one of several financial measurements that look at how much capital comes in the form of debt (loans) or assesses the ability of a company to meet its financial obligations. The leverage ratio category is important because companies rely on a mixture of equity and debt to finance their operations, and knowing the amount of debt held by a company is useful in evaluating whether it can pay off its debts.”

Basically, the leverage ratio is a set of ratios with the help of which you can highlight the financial leverage of a business when it comes to assets, liabilities, and equities. The ratio gives you an idea of how much of the capital of a business comes from its debt. Hence, you will get a good idea of whether the business makes well for its financial obligations.

Read More: Network Marketing: What Is It? Is It The Right Option For You?

How Does Leverage Ratio Work?

According to Hubspot.com,

“A higher financial leverage ratio indicates that a company is using debt to finance its assets and operations — often a telltale sign of a business that could be a risky bet for potential investors. It can mean that earnings will be inconsistent, it could be a while before shareholders can see a meaningful return on their investment, or the business could soon be insolvent.”

These metrics are really useful for creditors and investors to find out whether they should extend credit to or invest in the business. If the financial leverage ratio of a company is very high, it means that the company is allocating most of its cash flow to pay off its debts and is more prone to default on loans.

On the other hand, if the financial leverage ratio of a business is low, it shows that the business is financially responsible and has a steady stream of revenue. Even if a company is in significant debt, having a good financial leverage ratio shows that there are minimal risks for investors and creditors, and the business is likely worth an investment.

Leverage Ratio – How To Calculate It?

The following are the different formulae of leverage ratios based on the type of ratio you want to choose:

1. Operating Leverage Ratio

You can calculate it using this formula:

| Operating Leverage Ratio = Percentage change in EBIT (earnings before interest and taxes) / Percentage change in Sales |

2. Net Leverage Ratio

Here is the formula to calculate this ratio:

| Net Leverage Ratio = (Net Debt – Cash Holdings) / EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization) |

3. Debt-to-EBITDAX

You can calculate EBITDAX using this formula:

| EBITDAX (Earnings before Interest, Taxes, Depreciation, and Amortization before Exploration Expenses) = EBIT (Earnings before Interest and Taxes) + Depreciation + Amortization + Exploration Expenses |

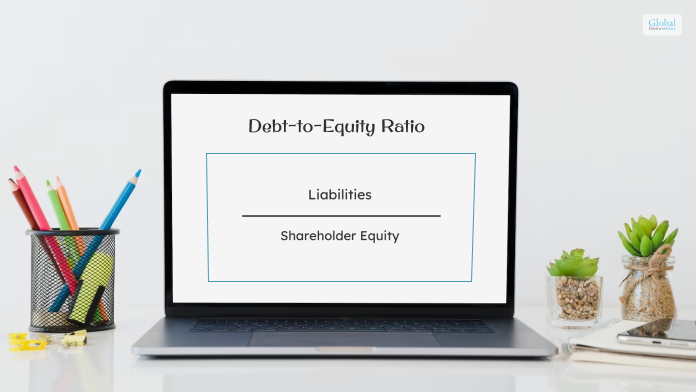

4. Debt-to-Equity Ratio

Here is the formula to calculate this ratio:

| Debt-to-Equity Ratio = Liabilities / Stockholders’ Equity |

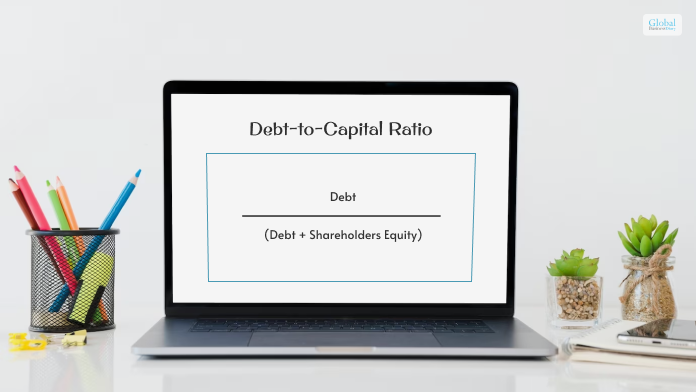

5. Debt-to-Capital Ratio

You can calculate it using this formula:

| Debt-to-Capital Ratio = Debt / (Debt + Shareholders Equity) |

6. Debt-to-Capitalization

Here is the formula to calculate this ratio:

| Debt-to-Capitalization Ratio = (Short-term Debt + Long-term Debt) / (Short-term Debt + Long-term Debt+ Shareholder Equity) |

7. Interest Coverage Ratio

You can calculate it using this formula:

| Interest Coverage Ratio = Operating Income / Interest Expenses |

8. Fixed-Charged Coverage Ratio

Here is the formula to calculate this ratio:

| Fixed-Charged Coverage Ratio = EBIT (Earnings before Interest and Taxes) / Interest Expense of Long-term Debt |

By having a good idea of your leverage ratios related to a business, you might understand how the business can run in the near future.

Why Is Leverage Ratio Important?

According to the Wall Street Mojo,

“Leverage ratios are important as they allow investors to assess a company’s financial position with respect to its financial obligations. Though firms have an option of using their equity to purchase assets and resources for undertaking different business activities, they go for taking up loans to finance their capital building. The reason is one – the cost of debt or cost of borrowing is way less than the cost of equity.”

The different types of leverage ratios help investors get a better idea of how the business’s capital flow is structured. By calculating these ratios, you can have information about a company in regard to whether it can take advantage of its leverage or not.

For example, if the company you want to invest in or lend credit to has taken too much debt, it is obviously risky for you. On the other hand, if the leverage ratio is too low and the company does not have any debt, it will be able to pay off too much cost of capital and reduce its earnings in the long run. Hence, consider your choices carefully.

Read More: Project Management: What Is It? – Major Types, Examples, And More

Wrapping Up

Hope this article was helpful for you in getting an understanding of how a leverage ratio works. You can see here that this is one of the major financial tools with the help of which you can assess a company’s ability to meet its financial obligations. By using it to measure operating expenses, you can get an idea of how differences in output can change operating income.

The debt-equity ratio, equity multiplier ratio, degree of financial leverage, and consumer leverage ratio are some of the common leverage ratios. Do you have any more information to add regarding how to calculate the leverage ratio? Share your ideas and opinions with us in the comment section below.

Read More: