Home Credit: Information, Eligibility Criteria, Interest Rates, Review & More

If you are looking for quick and instant personal loans, you must download the Home Credit app on your smartphone and explore the platform. The starting rate of interest on a Home Credit Personal Loan is 2% per month. Furthermore, you can get a loan amount of up to 5 lakhs and also get a loan tenure of up to 51 months.

The best part about HomeCredit Finance is that you will get personal loans within a matter of minutes after your document verification is done. In this article, we will mainly discuss the various loan-related features of Home Credit, its rate of interest, the eligibility of the borrower, and customer reviews. Hence, read on through to the end of the article to get fully informed.

Home Credit – General Information

If you want to avail of loans from the Home Credit platform, you will need to show your documents to the lenders on the platform. Home Credit is a non-banking financial company, and it claims to provide loans at low-interest rates within only a few hours of application for the loan.

If you apply for a loan now, you will get your loan within a few hours. However, your personal documents must be verified, and you will have to show your reason for availing of your loans. On the other hand, you will also need to make sure that all the documents you provide are true, and you will also need to provide your scanned photo and your current selfie.

Home Credit – Personal Loan Highlights And Loan Features

The following are the major highlights that will give you a better idea of the loan features of the Home Credit personal loan platform:

| Home Credit Personal Loans | |

| Loan Amount | Up to ₹5 lakhs |

| For existing Home Credit Borrowers | Minimum: ₹10,000Maximum: ₹5,00,000 |

| For new Home Credit Borrowers | Minimum: ₹25,000Maximum: 2,00,000 |

| Rate of Interest On Loan | 2% per month onwards |

| Loan Tenure | – For existing Home Credit Borrowers: 9 months to 51 months |

| – For new Home Credit Borrowers: 6 months to 48 months | |

| Minimum Income to Avail Loan | ₹10,000 |

| Loan processing fees | 0% to 5% of the Principal |

| Foreclosure fee | None |

| Flexible Personal Loan Processing Fees | 2.5% of the loan amount |

| Home Credit India Address (Home Credit office near me) | DLF Infinity Towers, Tower C, 3rd Floor, DLF Cyber City Phase II, Gurgaon-122002, India |

| Home Credit customer care number Delhi | +91 – 124 – 662 – 8888 (Between 9:00 AM – 6:00 PM, All Days) |

| grievanceofficer@homecredit.co.in |

Home Credit – Late Payment Charges (Personal Loan)

| Annualized Percentage | Starts From 24% | ||||||

| Number of days due | 1 day | 30 days | 60 days | 90 days | 120 days | 150 days | 180 days |

| Late Payment Charges | ₹350 | ₹450 | ₹550 | ₹750 | ₹750 | ₹750 | ₹750 |

| Total Late Payment Charges | ₹350 | ₹800 | ₹1350 | ₹2100 | ₹2850 | ₹3600 | ₹4350 |

Home Credit – Eligibility And Required Documents

The followings are the eligibility and the required documents needed at the time of availing loans from Home Credit:

Eligibility- If you want to avail of loans from Home Credit, you must fulfil the below-mentioned eligibility:

- Must be a citizen of India

- Must be either of the three: Salaried employee, Self-employed individual, or pensioner.

- Must be aged between 19 to 68 years.

- Must have an active bank account.

- At least 90 have passed since the last Home Credit loan application.

Required Documents- The following are the documents you need to have for verification of Home Credit personal loans:

- PAN Card

- Address Proof: Voter ID Card/ Driver’s License/ Property Tax Receipt/ Passport Government House Allotment Letter.

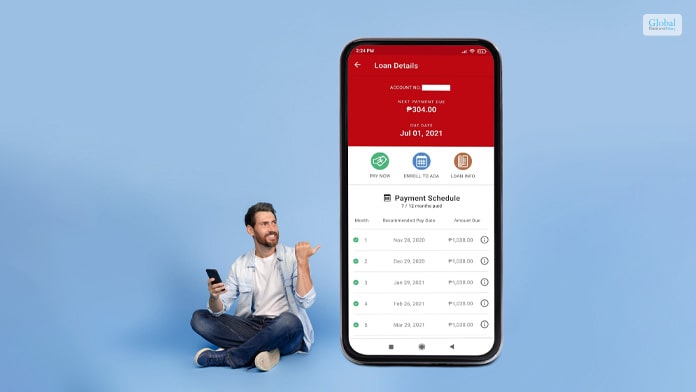

How To Download Home Credit App?

The following are the steps you will need to follow to download the Home Credit Loan App on your smartphone from Google Play Store:

Step 1: Open Play Store on your Android smartphone.

Step 2: On the search bar, type “Home Credit.” Tap on the “Home Credit: Loan App” option. (You can also apply for Home Credit loans by going to the following website: https://www.homecredit.co.in/en/home)

Step 3: Tap the install button, and then let the download and installation process take place.

Step 4: Once the Google Home Credit app is installed on your smartphone, you can start the app and then do a Home Credit loans login to get access to the variety of loan options.

Home Credit – Top Borrower Reviews

The following are some of the interesting reviews by Home Credit borrowers that must be helpful for you:

“WORST EXPERIENCE WITH HOME CREDIT . THESE GUYS IRRITATE THE CUSTOMERS AND DEDUCT AMOUNT REGULARLY FROM BANK ACCOUNT. FORCED FOR THE VALUE ADDED SERVICES AND DONT REFUND AMOUNT. I REQUESTED TO ALL OF U PLEASE DON'T TRUST ON HOME CREDIT FINANCE.” BY :- JITENDRA MEENA

“DON'T TAKE ANY KIND OF LOAN , SERVICES BAD , HIDDEN CHARGES , INTEREST PERCENTAGE VERY HIGH., AND CUSTOMER SERVICE REPRESENTATIVE VERY POOR CATEGORY.” BY :- bagderahul04

“I LIKED HOME CREDIT MINI CASH LOAN OPTION VERY EASY PROCEDURES. I TAKEN MINI CASH LOAN FROM HOME CREDIT FOR MY SON SCHOOL FEES ON THAT IT'S REALLY HELPS ME. I GOT 2 DAYS DELAY TO GET CREDIT BUT REALLY HAPPY WITH HOME CREDIT. I THINK THIS IS THE FIRST FINANCE GIVEN THIS TYPE EASY PROCEDURE TO GET LOAN. THANKU” BY :- MANJU6431

“I HAVE PURCHASED 2 MOBILE PHONES THROUGH HOME CREDIT INDIA WITH ZERO DOWN PAYMENT. ONLY A SMALL AMOUNT OF PROCESSING CHARGES. MINIMUM DOCUMENTS REQUIRED FOR THIS. AND THEY ALSO PROVIDE A SMALL FINANCE OF RUPEE 10000 FOR IMMEDIATE EMERGENCY. IT WILL BE AVAILABLE QUICKLY.” BY :- NEENU1234

Summing Up

As you have seen from the reviews of Home Credit in this article, the reviews related to the Home Credit app are mixed. However, you can also read popular reviews of Home Credit loan borrowers. If you see any hidden charges on the loan you are taking, ensure that you ask for full information. Make sure to read every piece of information related to the loans properly before you avail yourself of the loan from Home Credit. Although the app looks genuine, and the platform is certified, the borrower reviews say it all. Have you taken loans through the Home Credit app? Share your experience with us in the comments section below.

Have A Look :-