- Home

- Business

- Business Development

- How To Find The Best Content Creators To Work With

How To Find The Best Content Creators To Work With

As a brand, working with influencers is a highly effective way to boost brand awareness and generate sales.

Influencers are the new celebrities and they are just as influential as TV and movie stars nowadays. They are content creators who have built a strong and loyal following on social media and, as their name suggests, they have a huge influence on their audiences.

Every influencer is a content creator and vice versa. Anybody who posts content online has the ability to influence a specific group of people, especially those that post regularly.

If you want to maximize the reach of your social media campaigns, it’s a great idea to partner up with popular influencers and content creators. They can promote your products or mention your business in their posts so that their followers are exposed to your brand.

Finding the Best Content Creators to Work With

The question is, how can you find the best content creators to hire for your influencer marketing campaigns? Keep reading to learn how to do just this!

1. Perform Market Research

The first step when you’re trying to find great content creators to work with on your marketing campaigns is market research. Before you can decide who to hire, you need to know exactly what your target audience wants and need.

Performing some market research enables you to clearly define the aims of your campaign so you can find content creators that align with your goals. Consider the platforms that you want to use and where your target market can be found online. This way, you can narrow down your search for the most suitable influencers.

2. Find Influencers Who Align With Your Brand

Having a consistent tone of voice is essential for your brand. Partnering up with content creators who share the same tone, style, and values as your business will ensure your campaign is successful.

You need to find influencers who have built a following of people who are in your target audience. They should be in the same industry as your brand so that when they post about your products or services, their followers are genuinely interested in your brand.

You can provide your partners with the right tools to create the best content for your socials, such as an online background remover or digital content brief.

3. Consider Content Creators of All Sizes

Influencers and content creators come in all sizes., from macro to micro. We’re not talking about their body types! We’re talking about their follower or subscriber counts.

When you’re searching for the best content creators to partner up with, consider the size of each person’s audience.

Do you want to reach as many people as possible by pairing with ‘macro’ creators with hundreds of thousands of followers? Would you prefer to partner up with micro-content creators who have under a thousand followers?

Creators with fewer followers will have a smaller reach but will usually charge less money per post. They may also have a better engagement rate than large influencers, despite having a smaller audience. Be sure to calculate the engagement rates of each influencer to make a more informed decision about who to hire.

Additionals:

Sumona

Sumona is a persona, having a colossal interest in writing blogs and other jones of calligraphies. In terms of her professional commitments, she carries out sharing sentient blogs by maintaining top-to-toe SEO aspects. Follow her contributions in RSLOnline and SocialMediaMagazine

Recent

Critical Thinking Exercises in the Digital Age and Emotional Intelligence Integration

Jan 14, 2026

Creative Seasonal and Milestone Greeting Ideas to Strengthen Client Relationships

Dec 20, 2025

Preserve More, Waste Less: How Thoughtful Packaging Helps Protect Your Food, Your Health, and the Environment

Nov 22, 2025

Strengthening Corporate Sustainability Through Smarter ESG Reporting

Nov 21, 2025

Related Articles

Ant Group: A Leading Fintech Organization

Ant Group is today formally known as Ant Financial. This is basically an affiliate company of the Chinese Conglomerate Alibaba Group. Additionally, it comprises the world's biggest mobile payment platform, Alipay. With almost 1.3 billion consumers and 80 million merchants, Ant group reaches almost $118 trillion networth today. You need to understand these realities whenever you are talking about the Ant Group. It is one of the leading Fintech companies in the world today. On 23rd October 2014, Alipay was renamed as Ant Group. Along with it, the company changed its name to Ant Group Co. Its headquarters is present in the Xihu district in Hangzhou, China. You need to know this fact from your end while attaining your requirements. Brief History About Ant Group Ant Group, formerly known as Ant Financial Services Group, is an affiliate company of the Chinese Alibaba Group. Founded in 2004 as Alipay, a payment service for Alibaba's e-commerce platform, Ant Group has since grown into a financial technology (fintech) giant. Alipay was initially created to provide a secure online payment system for Alibaba's customers. It quickly expanded its services to include online banking, credit services, wealth management, and insurance products. In 2011, Alipay was restructured into Ant Financial Services Group, with a focus on providing a wide range of financial services. Ant Group's growth was fueled by the rapid adoption of mobile payments in China, driven by the widespread use of smartphones and the increasing popularity of online shopping. Alipay became the leading mobile payment platform in China, processing billions of transactions annually. What Are The Core Services Of Ant Group? There are several core services of Ant Group that you need to know about if you want to grow your career here. You need to get through the complete service pattern that can boost the scope of your earnings. There are certain key factors that you must know about it here are as follows:- 1. Making Digital Payments Ant Group's flagship service is Alipay, a digital payment platform that allows users to make online and offline transactions. Alipay supports various payment methods, including QR codes, barcodes, and contactless payments. You must make a digital payment solution that can help you in reaching your goals with complete ease. Without knowing the facts, things can become more complex for you. Over the years, they have advanced their technology further to meet their goals. 2. Offers Digital Banking Solutions Ant Group provides digital banking services through MYbank. It is an online bank that offers savings accounts, loans, and other financial products to individuals and small businesses. MYbank uses technology to streamline its operations and provide services to underserved populations in China. The best part is it offers complete digital banking solutions that can offer you complete solutions to meet your requirements. It is a leading Fintech solution provider that can boost your chances of earning and ensure long-term solutions. 3. Ensures Wealth Management Ant Group offers wealth management services through Ant Wealth. It is a platform that allows users to invest in a wide range of financial products. This includes mutual funds, stocks, and bonds. Ant Wealth provides personalized investment recommendations based on user preferences and risk tolerance. Proper wealth management is possible with the Ant Group. You need to be well aware of it while you make use of this leading Fintech Organization. With proper planning, things can become easier for you in the long run. This is among the global Fintech companies that can meet your needs with ease. 4. Offers The Insurance Services Ant Group provides insurance services through Ant Insurance, offering a variety of insurance products, including health, life, and property insurance. This company uses technology to simplify the insurance process and provide affordable coverage to customers. They can offer you some customized insurance services that can pull you out at the time of emergencies. Without knowing the facts, things can become more complex for you in reaching your objectives with ease. The evolution of Fintech is making the way for companies like Ant Group. 5. Delivers Credit Services This company offers credit services through Ant CreditPay, a platform that provides small loans to consumers and businesses. Ant CreditPay uses big data and AI technology to assess creditworthiness and offer loans quickly and efficiently. You will receive Credit services that can boost your brand value to a higher level. It can make things work in perfect order while attaining your requirements. If you have a good credit score, then you will get the loans from Ant Pay. 6. Offers Blockchain Solutions This company involves Blockchain technology, offering solutions for supply chain finance, cross-border payments, and other applications. Ant Group's blockchain solutions aim to improve transparency, security, and efficiency in financial transactions. Cryptocurrency transaction is also possible with the help of Ant Group. You can make use of their App to make the Cryptopayments. This can boost the chances of your brand value to the next level. Once you make your selection and choices in the correct order, things can become easier for you. What Are The Benefits Of Ant Group Services? There are several benefits of Ant Group Services that you must know at your end while attaining your requirements with ease. Some of the key factors that you should know at your end are as follows:- 1. Convenience Ant Group's services, such as Alipay and MYbank, are accessible through mobile devices, allowing users to manage their finances anytime, anywhere. You will get things done in perfect order. For that reason, convenience plays a vital role here. Try to make things happen as per your requirements. However, the digital payments of Ant Group will offer you ample scope of digital payment convenience. 2. Accessibility Ant Group's services are designed to be inclusive. Thus reaching underserved populations in China and providing them with access to financial services. You need to know the facts that can assist you in reaching your requirements with ease. Accessing the payment process in remote areas of China can make things easier for you in the long run. Therefore, you can transfer money whenever you need. 3. Ensuring Higher Efficiency Ant Group's use of technology, such as AI and blockchain. It enables it to provide fast and efficient services, such as quick loan approvals and instant payments. A higher level of efficiency will boost your brand value. Thus, it can lead to long-term problems if you are not aware of it. Try to follow the best process that can make situations work for you in all possible ways. 4. Offers Cost Effectiveness Ant Group's services often have lower fees and costs compared to traditional financial institutions, making them more affordable for users. It is one of the leading Fintech business units that can boost the chances of your brand value to a greater level. Once you follow the correct process, things can become easier for you to reach your objectives with ease. 5. Provides Proper Innovation Ant Group is known for its innovative approach to financial services, constantly introducing new products and features to meet the evolving needs of users. Innovating things can become easier for you when you make use of Ant Group services. The best part is you can customize their services as and when you need them. 6. Financial Inclusion Ant Group's services have played a significant role in promoting financial inclusion in China. Thus providing access to financial services for millions of people who were previously unbanked or underbanked. People who do not have a bank account will seek the services of Ant Group to a great extent. Try to follow the right services that can boost the scope of your earnings to a higher extent. 7. Offers Security Ant Group's services are designed with security in mind. Thus, it incorporates features such as encryption and authentication to protect users' financial information. Cyber security issues can be resolved with the updated technology of Ant Group in the process of financial transactions. Thus, it can boost the chances of your brand value to a great extent. What Are The Career Opportunity Present In Ant Group In 2024 There are several career opportunities present in Ant Group. You must be well aware of it while attaining your requirements with ease. Some of the core career opportunities of the Ant Group are as follows:- E2E product manager. Compliance Senior Manager Or Manager. Business Partnership Manager. Key Account Marketing Manager Limited Investment Operation Manager. AML Advisor. These are some of the career opportunities that you can seek from Ant Group. You must be well aware of the facts while meeting your needs with complete ease. Although, things can become easier for you to reach your goals with ease. What Are The Visions & Missions Of Ant Group In The Future? Ant Group's mission is to "bring the world equal opportunities" through technology. The company aims to use technology to make financial services more inclusive, efficient, and sustainable. Thus benefiting individuals, small businesses, and society as a whole. Ant Group's vision is to "empower the world to advance a future of digital trust and inclusiveness." The company envisions a future where everyone has access to financial services. They can participate in the digital economy with trust and confidence. Overall, Ant Group's mission and vision reflect its commitment to using technology to drive positive change in the financial industry and promote financial inclusion and sustainability globally. What Are Some Controversies With Ant Group? Every rose has its thorns, and the same is the case with Ant Group. They have also suffered some of the controversies in their journey of success. Some of the eminent controversies that encircled them are as follows:- 1. Regulatory Scrutiny Ant Group faces regulatory scrutiny in China over its rapid growth and market dominance. In 2020, Chinese regulators halted Ant Group's highly anticipated initial public offering (IPO). Additionally, they are citing concerns about the company's corporate governance and regulatory compliance. Along with this, they have undergone many challenges in the future. Employee retention strategies become a prime concern due to this controversy. 2. Market Dominance This company's dominant position in China's digital payments market has raised concerns about market competition and potential anti-competitive behavior. Regulators have taken steps to increase oversight of the company and the broader fintech industry. If you want to encounter market dominance, then Ant Group can offer you the opportunity to do so. 3. Data Privacy Controversy Like many technology companies, Ant Group has faced criticism over its handling of user data and privacy. There have been concerns about the collection, use, and sharing of personal data by Ant Group and its affiliates. You can protect the data with complete ease while attaining your requirements with absolute clarity. Additionally, this concern got the ant group in big trouble. 4. Consumer Protection Expansion into financial services has raised concerns about consumer protection. There have been cases of fraudulent activities and disputes involving Ant Group's products and services. Leading to questions about the company's responsibility to protect consumers. This was another bad phase of the Ant group that they have undergone over a certain point in time. 5. Political Sensitiveness Its ties to Alibaba Group and its founder, Jack Ma, have made it a target of political scrutiny in China. Jack Ma's public criticism of Chinese regulators in 2020 is widely seen as a contributing factor to the suspension of Ant Group's IPO. Final Take Away Hence, if you want to grow your business on the right track, then the application of Ant Group will help you reach your goals. You need to identify the best options that can assist you in reaching your requirements with ease. You can share your views and comments in our comment box. This can boost the chances of your brand value to the next higher levels. Without knowing the facts, you cannot make the correct decisions. Ant Group's services offer a range of benefits that make financial management more accessible, efficient, and secure for users. If you want to use a smooth financial system, then Ant Group can offer you the scope to make things easier for you to reach your goals. Continue Reading: Stripe A Leading Fintech Company: Essential Things To Know About It Tencent Holdings: A Journey From Failure To Success Global Fintech Companies Of 2024: Everything You Should Know About

Mar 06, 2024

Top Expert Network Companies In USA

Do you want to know about top expert network companies in the USA? If yes, you must read this article till the end to have a better idea of it. You must know the facts well about these companies before calling them to be the best in the business. Top expert companies in the USA will help you in reaching your objectives with complete ease. Identifying the income streams and leveraging the expertise will help you reach your goals with ease. Some leading companies in this sector will offer you some of the expert opportunities to build your wealth in the right direction. You need to follow right path when you want to know about the details of the top expert network companies. However, you need to consider the distribution channel as well. What Are Expert Networks? Expert networks are professional services that connect individuals or organizations seeking insights, information, or expertise with industry professionals, subject matter experts, and consultants who possess specialized knowledge in particular fields. In simple words, these companies are often thought leaders in specific industries. Thanks to their extensive expertise and skills in specific industries, they can provide varying levels of suggestions and solutions to clients seeking the same. These networks act as intermediaries, facilitating interactions between clients (such as businesses, investors, or researchers) and experts who can provide valuable insights, guidance, or information on specific topics. Although the challenges are huge here. Top Expert Network Companies Yes, expert network companies are industry specific. There are several that specialize in business services and have earned quite a reputation. The following are some names you can try. 1. GLG (Gerson Lehrman Group) GLG is one of the largest and most well-known top expert network companies globally. It connects clients with professionals across various industries for consultations and information. However, the chances of a backorder are less here. Furthermore, you can get access to a maximum market disorders. The Benefits Of Seeking Gerson Lehrman Group Are As Follows:- GLG has an extensive and diverse network of experts, including industry leaders, former executives, academics, and professionals from various fields. They provide clients with access to experts who have deep industry-specific knowledge. The company also facilitates quick and efficient connections between clients and experts. This can be crucial when clients need timely information or insights for decision-making, research, or strategic planning. Offers customized consulting services based on the unique needs of clients. GLG operates on a global scale, providing clients with access to experts from different regions and markets. 2. Guidepoint Guidepoint provides access to experts and industry professionals for consulting services. It connects clients with experts to help them make more informed business decisions. Some Of The Core Benefits Of Seeking The Services Of Guidepoint Are As Follows:- Guidepoint has a comprehensive and diverse network of experts, including professionals from various industries, sectors, and domains. The expert network provides clients with access to experts with deep industry knowledge. It facilitates efficient and timely connections between clients and experts. Offers customized consulting solutions based on the specific requirements of clients. It Operates on a global scale, providing clients with access to experts from different regions and markets. For clients in finance and investment, Guidepoint's expert network can be valuable for risk mitigation and due diligence. 3. AlphaSights AlphaSights is a global expert network that connects clients with industry professionals. It includes former executives, consultants, and academics to provide insights and expertise. Some of the core benefits of the Alpha sights include: - Some Of The Benefits Of Alpha Sights Are As Follows:- AlphaSights has a diverse and extensive network of experts worldwide, covering various industries, sectors, and regions. They provide clients with access to experts who possess deep industry knowledge. Facilitates quick and efficient connections between clients and experts. Offers customized consulting solutions based on the unique requirements of clients. AlphaSights prioritizes confidentiality and privacy in expert engagements. Expert networks such as AlphaSights are likely to stay abreast of industry changes and continuously adapt to meet client needs. 4. Thirdbridge Third Bridge connects clients with industry experts to gather insights and information. It serves a diverse range of clients, including private equity firms, hedge funds, and corporations. Some of The Benefits Of Thirdbridge Are As Follows:- Third Bridge provides clients with access to a diverse and extensive network of experts spanning various industries, sectors, and domains. Clients can benefit from industry-specific insights as Third Bridge connects them with experts who possess deep knowledge in specific sectors. Facilitates quick and efficient connections between clients and experts. Third Bridge offers customized consulting solutions based on the unique requirements of clients. Operating on a global scale, Third Bridge allows clients to access experts from different regions and markets. 5. Experts Exchange Experts Exchange focuses on connecting businesses and individuals with technology experts. It allows users to ask questions and receive expert answers. Following is some of the benefits of Experts Exchange - Some Of The Benefits Of Experts Exchange Are As Follows:- Expert Exchange provides users with access to a community of technology experts. Users can post technology-related questions on the platform and receive responses from experts. This network company covers a wide range of technology topics and categories. The platform fosters a sense of community collaboration where users can learn from one another. Users often bring real-world problems and challenges to the platform. 6. Zintro Zintro is an expert network platform that connects clients with experts across various fields for consulting and advisory services. They are one of the top expert network companies in the USA that you can consider -- Some Of The Benefits Of Zintro Are as Follows:- Zintro provides users with access to a diverse network of experts, including professionals, consultants, and industry veterans. Among across different fields and industries. Users can find experts with specialized knowledge tailored to their specific needs. This facilitates consulting and advisory engagements between users and experts. The platform typically employs a matching algorithm to connect users with relevant experts quickly. It operates on a global scale, providing users with access to experts from different regions and markets. 7. ProSapient ProSapient is an expert network platform that connects clients with industry experts, consultants, and professionals for research and advisory services. It is one of the top network expert companies in the USA. Some Of The Benefits Of Seeking The Services From ProSapient Are As Follows:- ProSapient provides clients with access to a network of experts spanning various industries and domains. Clients can engage with experts on ProSapient for customized consulting solutions. The platform likely employs an efficient matching process, connecting clients with relevant experts quickly. ProSapient's network may include experts from different regions, providing clients with access to global perspectives. Clients can engage with experts on ProSapient using different models, such as hourly consultations, project-based collaborations, or ongoing advisory relationships. Experts on ProSapient typically have verified profiles showcasing their credentials, experience, and expertise. 8. ENG ENG (Experts Network Group) provides access to experts for market research, due diligence, and consulting purposes. It is also one of the top expert network companies in the USA. Following are some benefits you’ll have if you hire them -- Some Of The Benefits Of seeking the services from ENG are as follows:- ENG provides clients with access to a diverse network of experts across various industries and domains. Clients can engage with experts on ENG for customized consulting solutions. The platform likely employs an efficient matching process, connecting clients with relevant experts quickly. ENG's network may include experts from different regions, providing clients with access to global perspectives. Clients can engage with experts on ENG using different models, such as hourly consultations, project-based collaborations, or ongoing advisory relationships. What Are The Benefits Of Top Expert Network Companies? Upon hiring expert network companies, businesses can have several different benefits as we have mentioned here. Following are some examples - 1. Assess To Specialized Knowledge Expert networks provide clients with access to individuals who possess specialized knowledge in specific industries, sectors, or domains. This allows clients to tap into the expertise needed for projects, research, or decision-making processes. 2. Global Expertise Many expert networks operate on a global scale, connecting clients with experts from different regions. This global reach provides clients with diverse perspectives and insights, particularly valuable in a world where businesses often operate across borders. 3. Quick & Targeted Insights Expert networks facilitate quick and targeted interactions between clients and experts. This can be crucial for obtaining timely insights, conducting market research, or making informed decisions within tight deadlines. 4. Efficient Decision Making By leveraging the expertise of industry professionals, clients can make more informed and data-driven decisions. Expert networks help streamline the decision-making process by providing relevant information and perspectives. 5. Adaptability To Industry Trends Expert networks are likely to adapt to emerging industry trends and technologies. This adaptability ensures that clients can access expertise relevant to evolving markets, technologies, and business landscapes. 6. Risk Mitigation & Due Diligence In sectors such as finance and investment, expert networks play a crucial role in risk mitigation and due diligence. Clients can consult experts to assess investment opportunities, evaluate market risks, and make informed financial decisions. 7. Customized Solution Expert networks may continue to offer customized solutions based on the specific needs of clients. Whether it's a short consultation or a more extensive research project, the flexibility of expert network services allows for tailored solutions. What Are The Challenges Of Top Network Expert Companies? There are several challenges of the top network expert companies that you must know if you are planning to choose one. Regulatory compliances, data security and privacy concerns, data security and privacy concerns, Ethical considerations, and privacy concerns are among the most common challenges of hiring a Network Expert Company. 1. Regulatory Compliance Compliance with regulations and legal standards is a significant challenge for expert network companies. Ensuring that engagements comply with privacy laws, data protection regulations, and industry-specific guidelines can be complex. You must know these facts that can help you in attaining your goals with complete clarity. 2. Data Security & Privacy Concerns Given the sensitive nature of information exchanged during expert-client engagements, maintaining robust data security and privacy measures is critical. The risk of data breaches and ensuring client and expert confidentiality are ongoing challenges. 3. Ethical Considerations Ensuring ethical conduct and preventing any misuse of information is crucial. Companies need to establish and enforce ethical guidelines to maintain the integrity of expert-client interactions. You cannot overcome the challenges unless you work ethically. 4. Quality Assurance Maintaining the quality of expert insights and ensuring that clients receive accurate and reliable information is a challenge. Expert network companies must continuously assess and monitor the expertise and credibility of their network members. However, maintaining quality assurance at a time can prove to be an even bigger challenge than it seems to be. 5. Matching Algorithm Accuracy Many expert network companies use matching algorithms to connect clients with relevant experts. Ensuring the accuracy and effectiveness of these algorithms in identifying the right experts for specific queries is an ongoing challenge. Final Take Away Expert networks play a crucial role in helping businesses and professionals make more informed decisions by tapping into the specialized knowledge of industry experts. They are commonly utilized in areas such as investment research, market analysis, legal due diligence, technology assessments, and strategic planning. If you are planning to use any such services, make sure to follow both the challenges and rewards of hiring one. In this article, we have already offered solutions you might be looking for. Thank you for reading. Read More: Market Orientation – What Is It, And How Does It Work? What Is Continuity In Business, And Why Is It Important? Business Continuity Plan – What Is It, And How Does It Work?

Jan 31, 2024

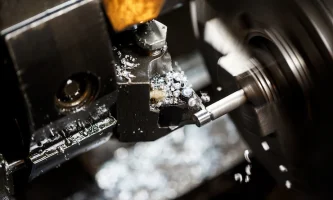

Tips to Update Your Manufacturing Business through CNC Machines

How does providing your clients with more products at shorter lead times sound? How about improved manufacturing productivity, repetitive accuracy, manufacturing various complex parts in different markets, and reduced scraps? Your manufacturing business using manual methods can reap these benefits when you update with CNC (computer numerical control) machines. Technology keeps moving forward, so don’t get left behind. Set your goals right now, plan out strategies, and consider these tips to update your manufacturing business through CNC machines. Take the First and Small Steps Calculate Fixed and Variable Costs Maximize Factory Space Evaluate Your Current Setup for the Appropriate Equipment Assess Your Manpower’s Capabilities Consider the Raw Materials for Machining Search for the Best CNC Systems Research and Talk with CNC Machine Companies or Suppliers Here are the tip details. 1. Take the First and Small Steps Starting is always challenging. You just have to take the first step and continue with a small step at a time when updating your manufacturing business through CNC machines. P&T Precision Engineering started with a vertical milling machine and updated to another CNC machine every two years. Over the years, they were able to update to the most sophisticated CNC machines doing the most complex processes. According to USC, you should replace the most heavily manual machine first for the highest cost and time savings and faster return on investment (ROI). 2. Calculate Fixed and Variable Costs Don’t get overwhelmed by the dreadful costs or flattering results. Costs can be manageable when you consider the fixed and variable costs for updating your manufacturing business with CNC machines. Fixed Costs Take into account the capital expenditure you would incur in purchasing the machine. Include in your computation the machine’s depreciation value and the interest in case you opt for a loan. Variable Costs Consider also the following variable costs in updating through CNC machines. materials you use operators, personnel training, and other manpower expenditures maintenance and servicing machine spare parts tooling Calculate well because cheaper CNC machines do not secure the effective production and profitability of your manufacturing business. To obtain promising results, devise short-term and long-term plans and properly implement your strategies. 3. Maximize Factory Space Does your factory have room for new machines? Does your factory space facilitate the productivity and safety of workers? A negative answer to these questions entails an effort to maximize your factory space, including room for expansion. A maximized factory space ensures efficient worker movements from one machine or process to another. The efficient flow and movement of raw materials and end products from one place to another, as well as collection and disposal, must be ensured. You must also provide power sources to strategic locations in your factory. And most importantly, provisions for workers’ safety must be in place. 4. Evaluate Your Current Setup for the Appropriate Equipment Your existing machine needs updating to a CNC machine when it no longer functions according to its intended purpose. Evaluate if the CNC machine replacement is cost-effective, including the machine’s current gaps and life span. Your evaluation will enable you to select the appropriate equipment to purchase. Update to CNC machines based on your existing manufacturing services and clientele. As mentioned above, you can gradually upscale to more advanced machines depending on your manufacturing business’s growth. CNC machines process parts with complexity and precision. If you invest in more advanced machines, you will be able to manufacture other types of parts and use different kinds of raw materials, thus entering new markets and creating new income streams. If your goal is to manufacture parts for aerospace, automotive, defense, or medical industries, you may consider machining centers with 3 to 5 axes or turning centers with 2 to 8 axes. For the standard to highly complex processes or batch production, choose 2 to 5-axis horizontal or vertical CNC lathes or 3 to 5-axis milling machines. If your manufacturing business is geared toward heavy industry and machinery, horizontal boring mills are for you. 5. Assess Your Manpower’s Capabilities CNC machines need different skills and expertise compared to manual machines. Assessing the prior knowledge and capabilities of your machine operators and personnel lets you identify if they need training for the new machine. You can consult with your CNC machine supplier if they provide the appropriate training. Automated manufacturing machines require lesser human intervention, but you need not lay off workers. You can assign your personnel to other income-generating roles and tasks in your manufacturing business. 6. Consider the Raw Materials for Machining Whether you machine aluminum, copper steel, titanium, or even plastic, note that the type of raw materials affects factors like machine design, spindle to be utilized, durability, performance, and precision. The maximum spindle speed and the needed spindle motor power and torque also depend on the physical characteristics and optimal cutting conditions of the raw material. 7. Search for the Best CNC Systems You may say that all CNC systems are the same. The processes are different from one manufacturing business to another. Match your machine to the appropriate and most practical CNCs. The best CNC systems have effective, reliable, and user-friendly controls and stable software. 8. Research and Talk with CNC Machine Companies or Suppliers Be aware that you have to do prior research before talking with a representative of a CNC company. Doing your research first allows you to formulate questions and ask any concerns you will have to ask. Reach out to multiple suppliers and discuss with them the details about your business and your manufacturing business goals. The decision will be up to you after comparing the products and services they offer. Carry the Day with CNC Machines Don’t be left far behind your competitors. Don’t let the opportunity for your manufacturing business’s productivity, accuracy, repetitiveness, and new income streams fly. Embrace technology. Update through CNC machines by following these tips, and carry the day! Additionals Is Southeast Steel Detailing Inc A Good Company To Invest? What Is Nano Dimension? Is Nano Dimension A Good Investment? Impact Of Covid-19 On The World Market Economics And Its Future Which Entrepreneur Made Tractors Before Entering The Sports Car Business?

Nov 05, 2022

How Berkey Water Filters Can Help Businesses Save Money And Improve Employee Health

Imagine ditching expensive bottled water, worrying about tap water quality, and boosting employee health – all with one simple solution. Enter Berkey water filters, a game-changer for businesses seeking cost savings and a healthier workforce. What Are The Advantages Of Water Filters for Commercial Use An organization tries its level best to work relentlessly for the benevolence of its employees. Yes, you got it right; it is one of the core objectives of the business organization. It is found from several studies that the employees who are fit physically and mentally perform much better in the organization. One of the great steps in this process is taking care of the water that employees drink. The employee gives the core time of the entire day at their respective workplace. It has been estimated through different studies that the average employee operates with around 65% of their potential if they are not adequately hydrated. Considering this eye-opening factor, employers must try to arrange for adequate fresh water. However, we discuss some of the advantages of using water filters for commercial use. So, let's get started with the discussion! Less Sick Days According to a medical observation, around 35% of gastrointestinal illnesses are related to water. When an employee fails to attend office due to stomach-related illness, it increases the load and the problem of the entire team. It also increases the additional stress on the people. Therefore, installing commercial water filters boosts business opportunities while eliminating viruses and harmful bacteria. Boosting Productivity According to a study conducted by the Weil Cornel Medical College and research, dehydration, that is, lack of adequate drinking water, is responsible for the increasing afternoon slump. When you dehydrate, you tend to have less energy in your body to work hard. It decreases the individual's energy in performing the way they usually perform. Installing the commercial water purifier keeps the employees thoroughly energetic, and ultimately, it helps boost their productivity. Saving Money Installing commercial water purifiers helps save money for the organization. Prior to installing the commercial water purifiers, you might have been buying them from commercial vendors. But as soon as you install them, you will thoroughly feel the difference from within, especially in terms of the cost. The available water bottles commercially are quite expensive. The water from the purifiers is safer compared to that of the bottles. It may contain water from different sources that are unhealthy for the employees. This hazardous water can affect the health of the employees. If you run your organization, you must not be compromising with the selection. Large plastic water bottles are a major source of pollution. Therefore, installing Berkey water filters can undoubtedly be safe and secure. Key Considerations When purchasing commercial water purifiers for your business organization, you must consider some quality elements and standards. You may be bombarded with different water purification systems available in the marketplace. But before collecting them, you must be mindful of certain elements. Firstly, you must not compromise the quality of the water. Choosing a commercial RO water purifier will be beneficial. An organization must have zero-tolerance policies toward water quality. Apart from this, some other parameters include brand credibility, certifications, service backups, and others. Part 1: Quench Thirst, Quench Costs Bottled Water Blues: The average employee gulps down bottled water, costing businesses a hefty sum. A single Berkey filter, with replaceable filters lasting months, delivers clean water at a fraction of the price. Consider a 50-employee office: Bottled water cost: $2 per employee per day = $5000 monthly Berkey filter cost: $400 (one-time) + $60 filters (every 3 months) = $720 monthly That's an annual saving of $51,600, enough for new office equipment or employee wellness programs! Beyond Bottles: Forget delivery truck fees and recycling hassles. Berkey filters tap directly into existing water lines, offering convenience and eliminating waste. Plus, say goodbye to expensive maintenance contracts – replacing Berkey filters is quick and affordable. Tax Time Bonus: Some regions offer tax deductions for businesses investing in employee health initiatives. Research potential tax benefits associated with Berkey filters in your area – consult a tax professional for specifics. Part 2: Hydrate & Thrive: Healthier Employees, Happier Profits Hydration Hero: Studies show good hydration enhances employee productivity and overall well-being. Berkey filters go beyond tap water, removing potentially harmful contaminants like lead, chlorine, and fluoride. This can lead to reduced headaches, fatigue, and even long-term health benefits. Cleaner Water, Clearer Minds: Imagine employees worry-free about water quality, refilling reusable bottles with confidence. Improved peace of mind and reduced health concerns can translate to higher morale, engagement, and reduced absenteeism. Happy Sips, Happy Employees: Access to clean, filtered water shows employees you care about their well-being, boosting appreciation and satisfaction. Studies link workplace amenities like filtered water to employee happiness and retention, leading to lower turnover costs and a more positive work environment. Part 3: Your Berkey Journey Starts Here Addressing Concerns: Worried about the initial cost or filtering speed? While the upfront cost might seem higher, consider the long-term savings and health benefits. Berkey filters also offer various models to suit your office size and water needs. User testimonials and studies highlight their effectiveness and value. Finding Your Perfect Fit: Berkey offers different filter models, each with varying capacities. A small office might choose the Travel Berkey, while a larger company could benefit from the Big Berkey. Explore their website or consult a distributor for tailored recommendations. Real-World Impact: Don't just take our word for it. Businesses across industries are experiencing the Berkey difference. Read customer testimonials and case studies on their website to see how others are saving money and promoting employee health. Conclusion: Investing in Berkey water filters isn't just about clean water; it's about building a healthier, happier, and more cost-efficient workforce. Take the first step towards pure profits and employee well-being – contact a Berkey distributor today! Read Also: Navigating The Future Of Payroll: Emerging Trends In Employee Payment Methods What Is Bottleneck In Business? Everything You Should Know About It Here’s How Your Workers Comp Quote Is Calculated

Feb 20, 2024