Money View: Information, Eligibility Criteria, Interest Rates, Review & More

If you are on the search for instant personal loans, you will need to download the Money View app now. The Money View platform offers loans with very low interest rates. You can get loans for as less as 1.33% interest rates. Furthermore, Money View loan amounts range up to ₹5 lakhs, with loan tenure up to 5 years.

This article is basically a review of the Money View loan app. Furthermore, this will also be a Money View loan review. Apart from that, we will also discuss more about the types of loans offered by Money View, as well as the types of interest rates that you will get with each type of loan. Hence, if you want to get fully informed about the Money View loan app, consider reading through to the end of the article.

Money View Loans – General Information

If you are a self-employed person or a salaried employee, looking for an emergency loan, Money View is the best place for you to visit. The following are the major features of Money View personal loans:

The Loan Amounts Are Flexible

The loan amounts at Money View are not fixed, and depending on your needs and demands, you can get a variety of options when it comes to loans. From ₹5000 to ₹5 lakhs, you can get any amount between that.

You Will Get Loans Fast

The verification and loan approval at Money View is really fast. The verification process happens as fast as two minutes. Hence, in such cases, the disbursal of the loan amount is as fast as 24 hours. However, even if you do not get fast loans, you will get it within a couple of days.

Loans Are Free From Collaterals

One of the most worrying things about borrowers is the presence of collateral in loans. If you are getting loans from Money View, you will be able to get those loans free from collateral. This means, even if you are a defaulter of a loan, your collaterals will not be taken.

Low Rate Of Interest

One of the best things about Money View loan interest rates is that they are quite low. Since the Money View loan EMI payment depends upon the rate of interest, having a low interest helps loan borrowers a lot. The rate of interest starts at 1.33% per month.

Full Paperless Transactions

The loan borrowings are mostly free of any hassle with Money View. From the process of application, to the disbursement of the loan, everything is digital and paperless. This allows you to get a loan by not staying in person, and also get a loan fast. Apart from that, it contributes to the environment as well.

Flexibility In Repayment Of Loans

One of the best things about Money View personal loans is that you will enjoy flexibility with it. You can enjoy flexible repayment tenure of loans for up to 5 years with Money View. This is really helpful for individuals that have low monthly salary.

Low Credit Scores Applicability

You can borrow loans from Money View, even if you have a low credit score. Even if you have not taken a loan before, you can get once from Money View. The minimum CIBIL score that you need to have is 600, and the minimum Experian score required is 650.

Benefits Of Money View Loans

There are several benefits of the money view loans. You must go through the details of it while making your choices in the right direction. Money-view loans can be of great help for you when you are in dire need of that. You must go through the details to have a clear insight into it.

1. Quick & Convenient Application Process

Money View Loans offers a quick and hassle-free application process. You can apply for a loan online through their mobile app or website, reducing the time and effort required for loan approval. You need to understand the convenient process that can make things easier for you in attaining your requirements with complete ease. You should ensure that the chances of mistakes and errors are as low as possible.

2. You Will Receive Flexible Loan Amount

Money View Loans provides a range of loan amounts to suit different financial needs. You can choose a loan amount that aligns with your specific requirements. You need to get through the complete process that can make things easier for you in attaining your requirements with complete clarity. You should follow the right process that can make things easier and effective for your business.

3. Customized Loan Tenures

Money View Loans offers flexible repayment tenures, allowing you to select a repayment period that fits your financial situation. This can help you manage your monthly EMI payments more effectively. According to your budget, you can make the selection of your loan tenure. There are no forceful pressure on you regarding this matter.

4. No Collateral Required

Money View Loans are typically unsecured personal loans, meaning you don’t need to provide collateral or assets as security for the loan. This makes it accessible to a broader range of borrowers. You do not have to submit any kind of collateral to get the loans on time. You cannot just make things too complex from your endpoints.

5. Competitive Interest Rates

Money View Loans aims to provide competitive interest rates, making their loans more affordable compared to some other lenders. You will get the privilege to enjoy the competitive interest rates. You need to get through the process that can make things easier for you to reach your goals with complete clarity.

6. Quick Disbursements

Once your loan application is approved, Money View Loans often disburses the funds quickly, sometimes within hours, which can be beneficial in emergencies or urgent financial needs. You must tryout to seek for those kinds of loans whose process of disbursement is easier and effective for your brand. It can make things happen well in your way.

How To Download The Money View Loan App?

The following are the steps you need to follow to perform Money View app download:

Step 1: Open Play Store on your Android smartphone.

Step 2: On the search bar, type “Money View.” Tap on the “Money View: Personal Loan App” option.

Step 3: Tap the install button, and then let the download and installation process take place.

Step 4: Once the Google Money View app is installed on your smartphone, you can start the app and then do a Money View loans login, to get access to the variety of loan options.

Money View Loan Review – Loan Highlights

| Loan Aspects | Money View Offerings |

|---|---|

| Rate of Interest | 1.33% per month onwards |

| Loan Amount | INR ₹5000 to ₹5 lakhs |

| Tenure | Up to 5 years |

| Minimum Monthly Income | – Salaried Professional: ₹13,500- Self-employed individual: ₹15,000 |

| Loan processing charges | 2% – 8% of loan amount approved |

| Interest on overdue EMIs | 2% per month on overdue principal loan amount/EMI |

| Loan cancellation charges | No additional charges |

| Cheque bounce | ₹500 each time |

| Loan Eligibility Age | 21 to 57 years |

| Minimum CIBIL/ Experian Score | CIBIL: 600 and Experian: 650 |

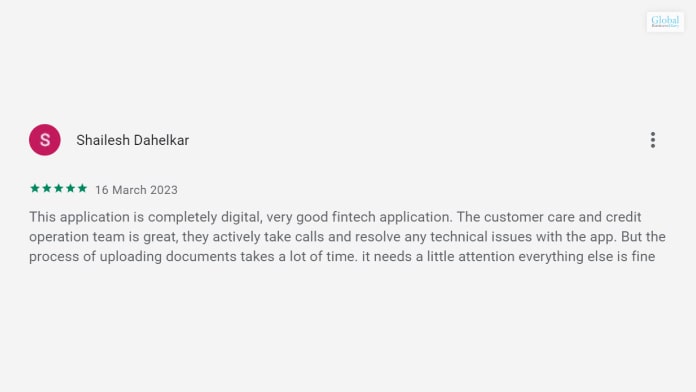

Money View Review – Borrower Reviews Of Money View

Although there have been some Money View loan consumer complaints, but mostly reviews are good. Take a look:

Summing Up

In this article, you learned about Money View, the app it provides, and the loan services it offers. Hope, now you have a better idea of the types of loan opportunities that Money View offers. If you are looking to avail yourself a loan from the Money View platform, consider visiting the official website of Money View. There you can visit the “Apply Online for Personal Loan” option, and click the “Apply Online” button.

Once you apply for a loan and your official documents get verified, you will be able to get a loan disbursal within 24 hours. If you have further questions about the Money View personal loan, consider asking it in the comments section below.

Have A Look :-