NIRA Instant Personal Loans: Are They Really Instant?

Do you have debts to pay off? Do you wish to buy a new smartphone, but the price tag makes you think otherwise? If you have such thoughts on your mind, and are looking for ways to get a loan as quickly as possible, then NIRA is the one you should be looking for.

This new quick loan establishment can provide you with various kinds of loans. But why be interested in them? Because they can provide these loans quicker than most banks and do not have a lengthy application period either!

To learn more about this company, read this post till the end.

NIRA Company Overview

NIRA was founded by entrepreneurs Rohit Sen and Nupur Gupta. They aim to provide people with instant cash loans as quickly as possible.

These two came up with this idea when they learned that banks take a long time to approve loans and credit the money to your account. Since they often find themselves in dire situations where they need cash within 48 hours, banks would often fail to do so.

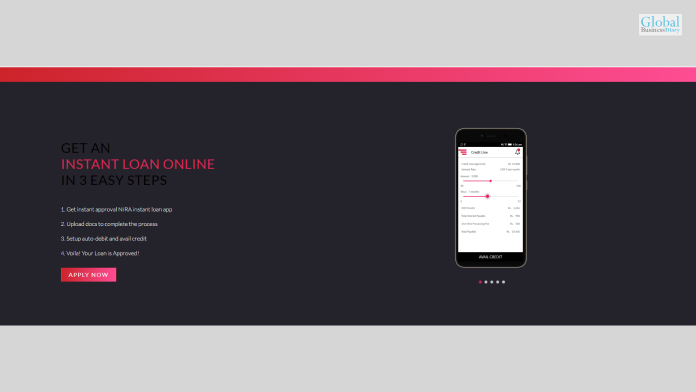

This is where NIRA comes in to provide you with instant loans. They are instant because you can apply for them using their NIRA smartphone app or website. The amount will be credited to your account in under 48 hours.

So far, NIRA has good reviews on various online publications s a trustable money-lending agency. However, their aggressive behavior towards clients when requesting their money back has been criticized a lot.

NIRA Instant Cash Loans

Instant Cash Loans by NIRA is the perfect financial solution if you need more money while planning your next vacation. Or you want to buy a new smartphone or laptop that you have wanted for a long time. Getting instant cash in such dire situations can be a pain, and NIRA understands that.

Getting instant cash loans from banks can be time-consuming since they have a lot of procedures and paperwork to follow. With NIRA, things are different. This company provides cash loans instantly after approval, which will reflect in your account within 48 hours. Plus, it’s less heavy on your pocket since you only have to pay a monthly interest rate of only 4%!

This Instant cash Loan can provide you anywhere between Rs. 5,000 to Rs. 1,00,000 in a matter of hours!

NIRA Instant Cash Loan Eligibility

To become eligible for NIRA Instant Cash Loans, you:

- Must be a graduate

- Should have a monthly income of Rs. 20,000

- Must be employed

Why Apply For NIRA Cash Loans?

There are various reasons why NIRA Instant Cash Loans will benefit you a lot.

1. Customizable Loans

Unlike pre-set loan amounts and fixed payment terms, NIRA allows you to customize it to your liking. You can get the amount you want and choose the period to pay it off. Pay off in 6 months? Yes, you can! Pay off in 12 months? Sure, why not!

2. Reasonable Interest Rates

The interest you pay depends on your credit score. Therefore, you will pay less interest if you have a high enough credit score! The interest rates will vary from 1.5% to a maximum of 4%.

3. Flexible Withdrawals

There are no withdrawal limits to your loan. You can pocket it all in one go or keep it in your account for the right time!

4. Credit History Not Required

While it’s beneficial to have a credit history and score, it’s not required here. The company understands that this might be your first loan. Therefore, CIBIL scores are unnecessary for newcomers. However, if you have a CIBIL score, you must ensure it’s above 681.

5. Quick Application

If you want a cash loan instantly, complete the online form and get it approved in under 3 minutes! NIRA values your request and your time as well!

6. Get Credited Within 24 Hours

Once your loan request gets approved, you will get the money sent directly to your bank account in 48 hours!

NIRA Personal Loans

Whenever people request loans, banks believe it’s to pay off large amounts of debt. Or maybe start a new business, who knows? However, NIRA has your back if you don’t wish to disclose your reasons for taking a loan. I mean, personal loans should remain personal, right?

NIRA Personal Loan Eligibility

You can become eligible for NIRA Personal Loans as long as you:

- Must be a graduate

- Should have a monthly income of Rs. 12,000

- Must be employed

- Should have a linked Aadhar card

Why Apply For NIRA Personal Loans?

You should apply for such personal loans because of various benefits like:

1. The Approval Process Is 100% Paperless

When you apply for a NIRA Personal Loan, you can do it online, anytime, anywhere. You don’t need to visit their headquarters and sign on piles of documents. Simply go to their official website, and fill out the loan application form in minutes!

2. Super Quick Credits

If you want a cash loan instantly, complete the online form and get it approved in under 3 minutes! NIRA values your request and your time as well. Once your loan request gets approved, you will get the money sent directly to your bank account in 48 hours!

3. Lower Interest Rates

The interest you pay depends on your credit score. Therefore, you will pay less interest if you have a high enough credit score! The interest rates will vary from 1.5% to a maximum of 4%.

4. Highly Flexible Payment Scheme

Unlike pre-set loan amounts and fixed payment terms, NIRA allows you to customize it to your liking. You can get the amount you want and choose the period to pay it off. Pay off in 6 months? Yes, you can! Pay off in 12 months? Sure, why not!

NIRA Mobile EMI Loans

Having a good smartphone has become a necessity in 2023. A high-end smartphone is a significant investment for work, photography, or gaming.

However, most good smartphones that you want cost above Rs. 40,000. Higher-end models by brands like Samsung, OnePlus, iPhone, and Motorola cost a lot. Paying the entire amount upfront in cash can take time and effort. However, paying it in EMI is an option everyone will agree with.

Therefore, why not apply for a NIRA Mobile EMI Loan and get the latest smartphones of your dreams?

NIRA EMI Loan Eligibility

To be eligible for Mobile EMI loans, you:

- Must be a graduate

- Should have a monthly income of Rs. 20,000

- Must be employed

- Should have a linked Aadhar card

Why Apply For NIRA Mobile EMI Loans?

The various benefits of applying for NIRA Mobile EMI Loans are:

1. Easily Liquefiable

Paying for a mobile phone way out of your budget can take time and effort. Therefore, save your liquid money for emergencies. Pay for the phone little by little over time!

2. Spend Less, Get More

Since you spend only a small amount of money every month, you can save a lot, which is only possible if you pay the entire amount in one go.

3. Zero Stress

I know how stressful situations can be when you have a broken phone and no money to buy a new one. However, if you can pay the price in installments, that will take the stress out of you!

NIRA Small Loans

If you are short of cash to pay for something you need, you should apply for a NIRA Small Loan. These are bite-sized loans that you will get instantly. Since these are small amounts, you can pay them in a few months’ time without any high-interest rates!

NIRA Small Loans Eligibility

To be eligible for NIRA Small Loans, you:

- Must be a graduate

- Should have a monthly income of Rs. 20,000

- Must be employed

- You should have a linked Aadhar Card

Why Apply For NIRA Small Loans?

The benefits of applying for NIRA Small Loans are:

1. The Entire Process Is 100% Paperless

When you apply for a NIRA Small Loan, you can do it online, anytime, anywhere. You don’t need to visit their headquarters and sign on piles of documents. Simply go to their official website, and fill out the loan application form in minutes!

2. Super Quick Credits, Directly To Your Bank Account

If you want a small loan instantly, complete the online form and get it approved in under 3 minutes! NIRA values your request and your time as well. Once your loan request gets approved, you will get the money sent directly to your bank account in 48 hours!

3. Lower Interest Rates

The interest you pay depends on your credit score. Therefore, you will pay less interest if you have a high enough credit score! The interest rates will vary from 1.5% to a maximum of 4%.

4. Flexible Payment Schemes

Unlike pre-set loan amounts and fixed payment terms, NIRA allows you to customize it to your liking. You can get the amount you want and choose the period to pay it off. Pay off in 6 months? Yes, you can! Pay off in 12 months? Sure, why not!

5. Want Multiple Loans? No Problem!

Since these loans are typically in small amounts, you can apply for multiple small loans at once. You will get what you want if you have a good credit score!

Conclusion

NIRA loan services have ventured into a section of the Indian money market that hasn’t been explored before. Providing loans in under 2 days just after filling up an application using a mobile phone is something other Indian banks have failed to do. So what are you waiting for?

Explore More: