Is PHI Stock A Good Buy? Everything You Should Know

PHI stock prices have shown a positive trend in the past few months. So chances are there that you can earn big if you invest in this stock.

Before investing in PHI stock, you need to understand its background and assets to withstand the stock holdings for a longer duration.

The Company is one of the oldest conglomerates in the USA and has shown a promising growth rate over the past few years. As a result, investors in the US stock market are now witnessing PHI stock as the safest option for them in 2022.

Company Profile & Background Of PHI Group

PHI( Provincial Holdings Inc) is one of the oldest companies in the USA. In 1982, it was established with the name of JR consulting.

The Nevada Corporation is primarily into mergers and acquisition business offerings. The company’s name got changed to Provincial Holding Inc after acquiring California’s Investment banking and asset management company in 2000.

In 2009, the company’s name was again altered as the PHI Group, and now it is operating its functions in the USA smoothly.

Reasons To Buy The PHI Stock In 2022

There are several reasons you should buy the PHI stocks in 2022 to get better returns from your investments. Some of them are as follows. But, first, it will hint at why you must buy the PHI Stocks in 2022.

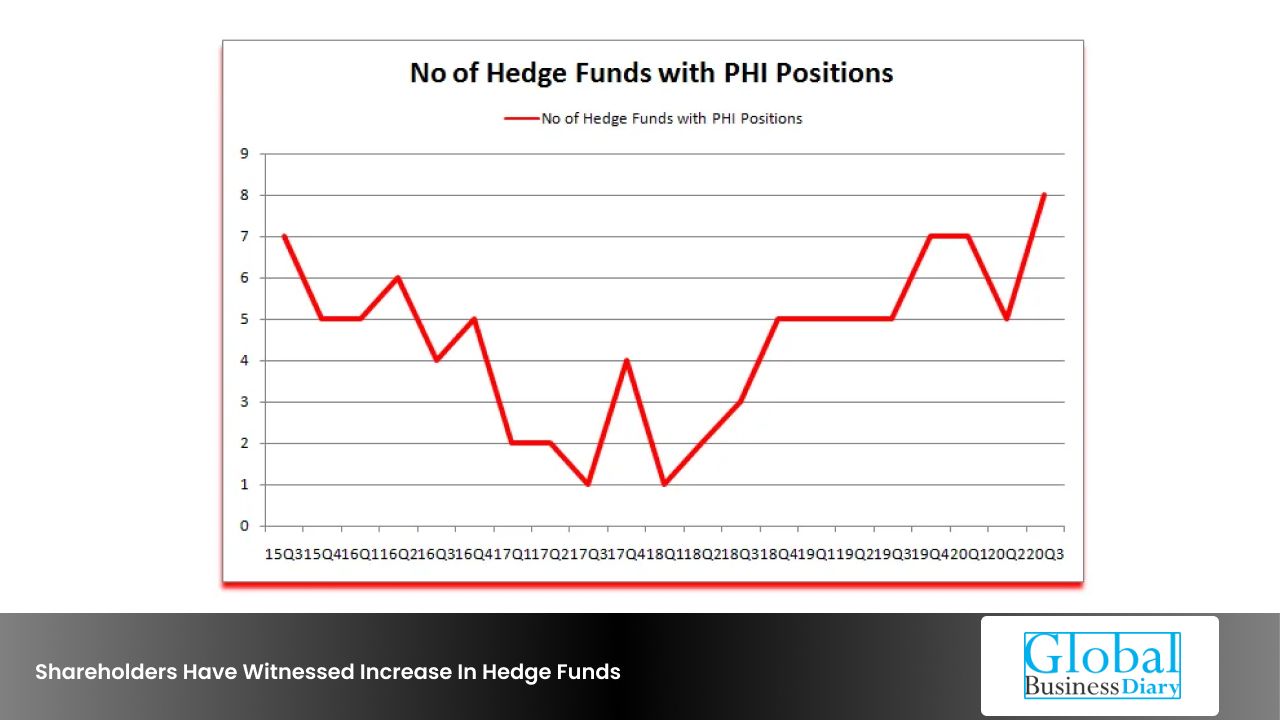

1. Shareholders Have Witnessed Increase In Hedge Funds

Shareholders have witnessed increased hedge fund interest over the last few quarters in PHI stock. As a result, it comprises eight hedge fund portfolios over the end of the third quarter in 2022.

The all-time high statistics of PHI stocks stand as 7 out of 10 ratings, and it will deliver better returns to its investors.

It comprises the bullish hedge fund situation for the stocks that sit for their all-time high. There are currently five hedge funds in all of the database positions for the PHI group.

2. PHI Stock Will Experience The Bull Run

Insider Monkey has analyzed PHI stocks, will show a bullish run in the upcoming years.

From the previous quarter, the growth rate of the stocks for the PHI group is more than 60%. Therefore, the shareholders can earn more from it if they can invest their money now. Later on, the prices of the stocks may fluctuate.

Hedge fund managers are boosting their Holdings and market caps on this stock. It is providing safe heaven to its investors during the upcoming years.

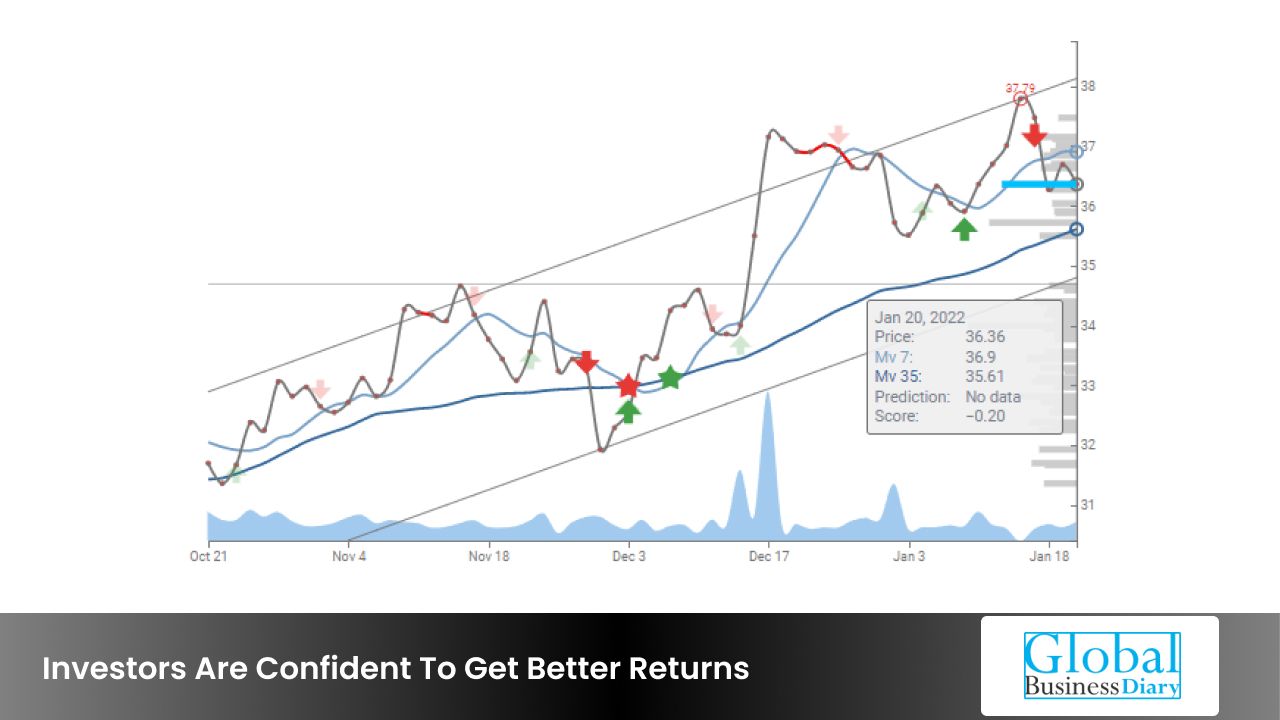

3. Investors Are Confident To Get Better Returns

Renaissance Technologies is now holding $91.5million worth of the shares of the PHI company, so the chances of returns will be higher.

The chances of earning from PHI stocks are more as bigger organizations are the clients of these companies, which ensures stable growth. Therefore, experts of the stock markets believe PHI will provide a higher stock return in the upcoming years.

The chances of price fluctuations and company debt are less. The PHI group believes in a Zero debt policy, and so PHI stock forecast will show better returns for their investors.

Also Check: Is MAX Stock A Good Buy? Everthing You Should Know

4. Agricultural Sector In US Is Showing Growth

You may wonder why I am talking about the agricultural sector in the context of the PHI group, right.

The PHI group invests its money in the Agricultural sector company’s stocks and earns the return. Currently, the stock prices of the agricultural sector are growing by 1.53 percent every year.

Due to this factor, the chances of the growth rate of the PHI group will be on the higher side, and you can get better returns from your investments. As a result, the PHI stock prices will increase rapidly and will deliver better returns for their investors.

5. Healthcare Sector Is Showing Steady Growth

The US government spends almost 18 percent of the GDP in the health care sector for its development and growth, and the PHI group also invests its money in this area.

Investors will get stable returns from their investments in PHI stocks as the management of the PHI group takes care of its investors very aptly.

The innovative leadership and out-of-the-box thinking ability of Mr. Fahman, who possesses 30years of experience in the Corporate management field and settling the Corporate management strategy, have never upset its investors. As a result, you can also expect better returns from this company.

6. Real Estate Industries Are Witnessing Healthy Returns

The average sale price of the real estate sector has increased in the past few years. Its count stands as 43 percent growth rate over the past few years.

The most astonishing fact for the investors of the PHI stockholders is that this company also invests its money in this area as well. The chances of earning more money increase when PHI makes more money from these country’s core sectors.

Do not waste your time and buy the stocks of PHI group to earn big within the next few years.

The Real estate sector will also grow rapidly in the upcoming years, and the investors will witness better returns from their investments.

Also Check: What Is SHLL? Is SHLL A Good Stock In 2022?

Final Take Away

The world market economics is changing rapidly, and countries like the USA are now showing a better growth rate post-COVID-19. As a result, the PHI stock prices will increase in upcoming years.

Experts of the stock markets are at least confident about the growth in the share prices of the PHI group. Now, you may have some different opinions about this fact.

You can feel free to share your opinions, comments, and advice in our comment box. Your opinion is valuable to us, and so we are expecting a valid reply from your end. Do not forget to share this article with your friends, peers, and colleagues.

FAQs ( Frequently Asked Questions)

More Resources: