FlexSalary: Information, Eligibility Criteria, Interest Rates, Review & More

The FlexSalary App is a loan app that is run by an Indian NBFC named Vivify India Finance Pvt. Ltd. The company is registered with the Reserve Bank of India. However, there are not many good reviews regarding the app. However, the app and the company seem legit. Hence, we have dived deep and reviewed the app in this article for you.

This article will consist of a review of FlexSalary, which claim to be one of the “Best instant loan app in India without salary slip.” Furthermore, we will also give you details about the interest rates, eligibility, and other loan-related information. Finally, we have also added some useful customer reviews regarding Flex Salary. Hence, to get fully informed about FlexSalary, read on through to the end of the article.

FlexSalary – What Does It Offer?

FlexSalary is an app where you can get a loan if you are a salaried individual. According to the official website of the company,

“FlexSalary is an instant salary advance credit line that covers emergency needs of Indians before they get paid. It aims to aid all individuals who face a mid-month crisis by providing short-term lines of credit loans until they receive their salaries. We offer instant loans from Rs. 4,000 to Rs. 2,00,000 with flexible repayment terms.”

It basically offers a personal line of credit. Even if you do not have a credit history, you will be eligible to get a loan from FlexSalary. If there are people who cannot find any other way to get financing, FlexSalary offers an unsecured line of credit.

| Loan Aspects | What FlexSalary Offers You? |

|---|---|

| Loan Amount | ₹ 4000 – ₹ 2,00,000 |

| Loan Tenure | 10 months to 36 months (Based on the loan applied for) |

| Rate Of Interest On loans | 10% to 12% per annum |

| Loan Processing Fees | ₹ 650 only (One-time payable only upon Loan Disbursement) |

| Collateral Or Mortgage | No collateral required |

| Loan Review Time | Depending upon the amount of the loan (may take from 5 minutes to 7 days) |

| Late Payment Of The Loan | Up to 5 %, depending on the type of loan applied for. |

| Loan Repayment | Loan repayment is made automatically from the provided bank details as per the approved schedule. Repayment should be made through the mobile app of FlexSalary. |

| FlexSalary Customer Care Number | +91-40-4617-5151+919908935151+919100038349 |

| CIN Number | CIN U65923TG2016PTC110767 |

| Address | Unit A, 9th Floor, MJR Magnifique, Survey No 75 & 76, Khajaguda X Roads, Raidurgam, Hyderabad, Telangana – 500008. |

Is FlexSalary Safe?

Yes. FlexSalary is fully legit and safe. The website is also safe to use as it is HTTPS-secured and SSL certified as well. However, regarding the customer service of the company, many borrowers of loans have complained. Despite that, as per our experience, we think the app works quite well and is legit. Furthermore, the company has a CIN number, and it is registered through the Reserve Bank of India.

When Can Flex Salary Comes To Rescue?

There are certain circumstances where flex salary comes to the rescue. You need to get through the possible solutions that can make things easier for you. You need to follow certain steps that can make things easier for you to attain your requirements with ease.

1. Don’t Have Collateral

Flex salary will offer you unsecured lines of credit loans. You do not have to pledge to your assets if the collateral gets approved for your loan. You need to get through the complete process that can develop things in perfect order.

2. If Your CIBIL Score Is Low

Flexsalary will not focus on your CIBIL score to provide you with the loan you need in times of crisis. If you have a low CIBIL score then you must go through the best flex salary options to meet your requirements with ease.

3. Need An Emergency Cash

If you are facing a medical emergency and you need the loan on an immediate basis, then you must consider using Flex salary. You need to identify the perfect solution that can make things lucid for your business development.

4. Loan Is Rejected By Banks

If you have low income, bad credit history, and banks have rejected your loans, then Flex salary can be the best option for you. Flex salary will offer you loans at times of crisis. You do not have to pay any kind of interest to get these loans.

5. Don’t Want To Pay Excess Interest

If you are afraid of bearing the higher interest rates on your loan, then Flex interest loan amounts can be one of the best options for you. If you do not use money, you do not have to pay the interest.

6. If You Need A Loan For A Lifetime

Flex salary personal line of credit you can receive for a lifetime. Your credit limit gets filled up once you pay back the withdrawn amount. It works almost like that of a credit card. You need to identify the perfect solution that can make things easier for you.

Can You Get An Instant Personal Loan For Your Marriage From Flex Salary?

Yes!! You can receive an instant personal loan for your marriage when you opt for the flex salary. If you have an urgent need for cash in order to meet your marriage-related expenses, then Flex salary can be of great help to you.

You will get the help for money within a few hours. It can help you to get the desired amount of money for a personal loan when you need it the most from your endpoints.

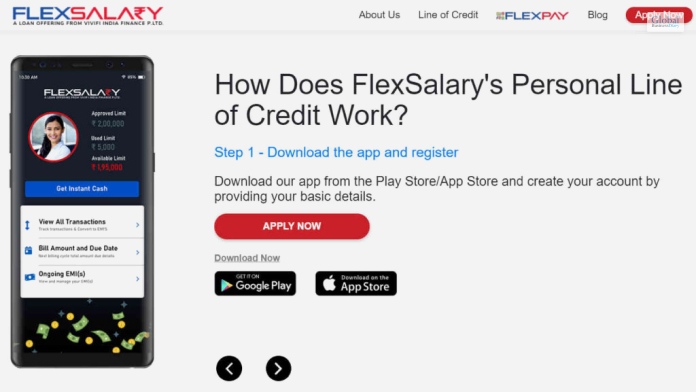

How To Do FlexSalary Login? – Steps To Follow

The following are the steps through which you can apply for a loan through FlexSalary:

Step 1: Visit their official website and click on “Apply for an Instant Loan.”

Step 2: You will get a form on the next page, which you will need to fill out and add information into. Add all the documents required to get a loan from the FlexSalary platform.

Step 3: There are various verification processes available. You can either apply for Net Banking Verification or you can upload the documents on your own.

Once you upload the documents, they will verify your credentials and will tell you what you are eligible for. Through the app, it is almost the same. All you need here is to download the app and register your account with it.

FlexSalary – Eligibility Of The Loan

| Loan Requirements | Eligibility |

|---|---|

| Age Of the Borrower | 22 to 60 |

| FlexSalary Credit Score | Depends on the type of loan applied for. |

| Type of Employment | Salaried professionals only. |

| Minimum Monthly Income | ₹ 8000 (However, it can change depending on the loan amount applied for) |

| Work Experience | Work experience requirements depend on loan terms and amounts. |

| Required Documents | 1. Salaried Employees- Identity Proof (Aadhaar / Driving License / Passport / Voter ID) – PAN card – Address Proof (Driving License / Utility Bills / Aadhaar / Passport / Bank Statements / Voter ID) – Last three months Pay Slips – Photo with the applicant’s face clearly visible. (The applicant will be prompted to take a selfie or upload a photo while applying for a loan through the FlexSalary mobile app) – Net banking verification to validate the bank account and salary information of the applicant 2. Self-Employed Individuals- No loan is allowed for self-employed- The applicant must have an employment |

FlexSalary Reviews From Customers

The following are some of the useful customer reviews regarding FlexSalary that you can benefit from:

Syed Abrar:

“I’m very happy much satisfied with the service Uma Maheshwari are very nice she was helped me through out the process I got the loan amount as soon as the documents were collected best app.”

Manjeera Dhfm:

“My credit limit was activated in 1day. But I was not able to withdraw amount,due to my account issue, then customer support team interacted with me continuously and solved the problem. Thank you team. They are well mannered employee’s who have patience to listen the issue and resolve it quickly.”

Selva Raj:

“Last month urgently required some amount, one of my friend referred me Flexsalary and they had treat me as a friend and pay me the amount with very minimum documents. Thank you Flexsalary very fast, very effective good customer service really appreciate your overall performance.”

Summing Up

Hope this article was helpful for you in getting a better idea of the FlexSalary platform. If you are hoping to get a loan from this platform, you need to download the app and register your account. Furthermore, you need to upload all the necessary documents. They will verify and give you the loan within one to five days if you are eligible for it. Do you know of any better loan app, which is registered by the Reserve Bank of India, and offers instant personal loans? Share some of them with us in the comments section below.

Explore More: