ACTC Stock – Present Price, Forecast, Statistics – Should You Invest In It In 2022?

Are you looking for the most accurate analysis of ACTC stock? Then you are at the right place. This guide is dedicated to all those audiences who are planning to invest or have already invested in ACTC.

So stay tuned with us and read till the end to get the answer of the question you are searching for – Is ACTC Stock A Worthy Investment Option In 2022?

What Is ACTC Stock? The Background

ACTC Stock or ArcLight Clean Transition Stock comes from the company named ACTC based in Alexandria, United State. It’s a part of the Offices of Physicians Industry. Believe it or not, it has a total number of 3 employees across all its locations and generates $72,282 in sales (USD).

What Happened To ACTC Stock?

In the early days of 2021, several speculations were hovering about the ACTC merger. So basically, ArcLight Clean Transition was supposed to be renamed Proterra in the first half of 2021 with a new symbol of PTRA.

And it happened as well successfully.

The organization did a prestigious job of presenting the prospects and financial forecasts in one of its business presentations.

Current Price Of ACTC Stock

The present ACTC stock price, which is on April 21, 2022, is USD $ 16.490.

Prediction Of ACTC Stock Price

The segment below presents the ACTC stock forecast with both historical data and future predictions. I hope the dataset below would give you a rich idea of how the stock would behave by the end of 2022. Take a look.

1. Historical Data

| Date | Opening price | Closing price | Minimum price | Maximum price |

| 2021-06-15 | Open: 16.940 | Close: 16.940 | Low: 16.940 | High: 16.940 |

| 2021-06-14 | Open: 18.748 | Close: 18.748 | Low: 18.748 | High: 18.748 |

| 2021-06-11 | Open: 18.951 | Close: 18.951 | Low: 18.951 | High: 18.951 |

| 2021-06-10 | Open: 18.782 | Close: 18.782 | Low: 18.782 | High: 18.782 |

| 2021-06-09 | Open: 18.963 | Close: 18.963 | Low: 18.963 | High: 18.963 |

| 2021-06-08 | Open: 18.956 | Close: 18.956 | Low: 18.956 | High: 18.956 |

| 2021-06-07 | Open: 18.917 | Close: 18.917 | Low: 18.917 | High: 18.917 |

| 2021-06-04 | Open: 18.867 | Close: 18.867 | Low: 18.867 | High: 18.867 |

| 2021-06-03 | Open: 18.723 | Close: 18.723 | Low: 18.723 | High: 18.723 |

| 2021-06-02 | Open: 19.093 | Close: 19.093 | Low: 19.093 | High: 19.093 |

| 2021-06-01 | Open: 18.518 | Close: 18.518 | Low: 18.518 | High: 18.518 |

| 2021-05-28 | Open: 17.698 | Close: 17.698 | Low: 17.698 | High: 17.698 |

| 2021-05-27 | Open: 17.106 | Close: 17.106 | Low: 17.106 | High: 17.106 |

| 2021-05-26 | Open: 16.601 | Close: 16.601 | Low: 16.601 | High: 16.601 |

Analysis: From the historical price chart of ACTC Stock Proterra above, you can see a dataset of 20221. From 26th May 2021 to 15th June 2021, the opening price, closing price, maximum and minimum price are found to be on an increasing trend. This indicates a long-term profit potential of Arclight Clean Transition Corp Stock.

2. Predicted Future Data

| May 2022 | 26.441 | 28.274 | 26.441 | 28.274 | 6.48 % ▲ |

| June 2022 | 28.243 | 29.186 | 27.575 | 29.186 | 3.23 % ▲ |

| July 2022 | 29.374 | 30.281 | 28.481 | 30.281 | 2.99 % ▲ |

| August 2022 | 29.388 | 31.190 | 29.388 | 31.221 | 5.78 % ▲ |

| September 2022 | 31.226 | 32.321 | 30.521 | 32.321 | 3.39 % ▲ |

| October 2022 | 31.428 | 32.335 | 31.428 | 33.228 | 2.8 % ▲ |

| November 2022 | 33.261 | 34.137 | 32.561 | 34.167 | 2.57 % ▲ |

| December 2022 | 34.173 | 35.268 | 33.468 | 35.268 | 3.11 % ▲ |

Analysis: The monthly ACTC stock forecast table above indicates that the price is going to rise from May 2022 to December 2022. So, that’s also a positive aspect of ACTC which indicates its growth potential.

52 Week High And Low Of ACTC Stock Price

The 52-week high and low values of ACTC Stock Proterra are here. I have given both historical and forecast values so that you get a clear idea of the yearly trading difference.

1. Historical Data

| 52 Week High | 52 Week Low |

| USD $31.06 | USD $9.7 |

2. Predicted Future Data

| 52 Week High | 52 Week Low |

| USD $28.733 | USD $16.241 |

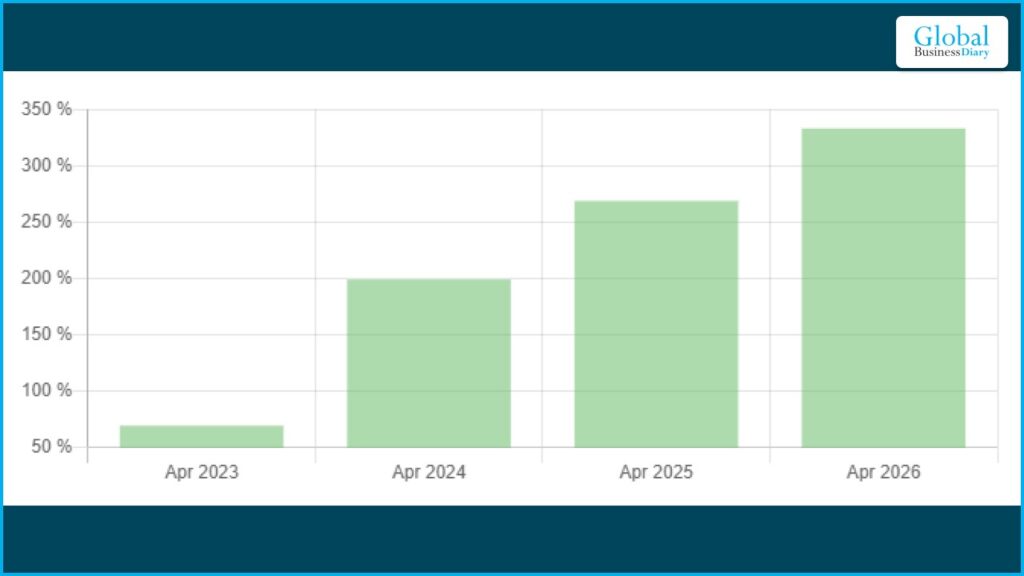

How ACTC Stock Is Going To Perform By 2027

Analysis: The diagram above denotes that ACTC Stock price is going to rise from April 2023 to April 2016 at a steady rate. ACTC stock forecast 2025 and 2026 is sufficient enough to make you understand how prosperous the long-term earning potential is.

Frequently Asked Questions (FAQs)

Ans: The ACTC Stock or Arclight Clean Transition Corp Stock price is USD $16.940.

Ans: Yes, the ACTC Stock price could go up from USD $16.940 to USD $28.733 USD in a single year.

Ans: According to ACTC Stock Forecast, the long-term earning potential is +69.61% in a single year.

Ans: As per ACTC Stock Forecast, the expected ACTC Stock price within the coming 5 years is USD $76.070.

Is ACTC Stock A Good Buy?

That’s all about ACTC Stock Proterra. It’s quite evident from the stock ACTC review that it’s definitely investment-worthy. Due to a high long-term earning potential, you can expect better profits by 2025. It’s noteworthy that after the ACTC Stock merger, its performance has gone up. Hence, there are considerable chances of ROI in the future.

Have Any more queries on it? Let’s meet in the comment section.

For more similar reviews on stocks like this, stay tuned with us.

Disclaimer: Respected Readers, the ACTC Stock price facts, and the data we presented above are all assumptions. All the data refers to those present on the leading cryptomarket websites. The actual values might be different on the basis of the market situation. Please note that share/stock prices are subject to market risks. Read all the documents and examine them carefully before investing.

Read Also: