Matrix Organizational Structure – What Are Its Pros And Cons?

In a matrix organizational structure, the teams within an organization try to bring different roles within the team together. Doing so, unlike a traditional hierarchical structure, they develop a grid-like reporting structure. Basically, the organization combines two or more structures from within. Here, both the traditional hierarchy of management as well as inter-department management is combined.

In this article, you will learn in general about a matrix organizational structure and how it works within an organization. In addition to this, we will also discuss the major pros and cons of this organizational structure.

Apart from that, we will also discuss the major roles within a matrix organizational structure. Hence, to learn more about such an organizational structure, read through to the end of the article.

What Is A Matrix Organizational Structure?

The matrix organizational structure basically combines two or more kinds of organizational structure. For example, let’s say you combine project management and functional management.

According to Indeed.com,

“Additionally, the matrix structure is composed of both a traditional hierarchy of management, where employees are managed by a functional manager, as well as additional project managers who can manage employees across different departments. These two or more managerial systems intersect on a grid or matrix.”

In this organizational structure, different management styles are used – where the functional management as well as the divisional management are combined. Here, functional management consists of the traditional hierarchical structure based on the job function and the organization’s department. On the other hand, a divisional manager is the one who presides over the cross-functional team, which consists of representatives of both teams.

An organization with a matrix structure has team members reporting to different managers. There might be a hierarchical manager while the team members may also have to report to their project manager.

This type of structuring is important for companies trying to create new products without the hassle of realigning their teams.

The matrix organizational structure combines the functional and the divisional managers. This helps the work processes to be done faster.

According to the Wall Street Mojo website,

“In a matrix structure, team members provide information to a project leader and their department head. This management structure might assist businesses in developing new goods and services without reorganizing teams.”

The matrix organizational structure was started in the aerospace industry. This was the time when many firms wanted to get into a contract with US Government employees. They needed to create certain charts that show the structure of the project management team.

How Does A Matrix Organizational Structure Work?

This structure is best understood with the help of an example. According to ChartHop.com,

“At the simplest level, an example of an organization using a matrix structure would be one that has set functional teams (e.g. Marketing, Sales, Customer Success) as well as more divisional teams with members from different functional areas that work together on specific initiatives.”

A common example of a matric organizational structure is Nike. The company has teams that operate the functional management like merchandising and HR, as well as divisional teams that operate based on location, demographics, and product.

Companies and their employees can get a lot of advantages with the matrix structure, especially with the ways that they work within the organization. The teams can share knowledge with each other and can make more informed decisions. Apart from that, the best thing that they will have is better morale within themselves.

However, there are problems that you can find inside a matrix organizational structure, too. Some of them include conflict, slowdown of processes, lack of clarity, and more.

Here’s how a Matrix organizational structure works –

- The employees report to two managers simultaneously. A functional manager is responsible for their overall role in the department.

- Their project manager, on the other hand, is responsible for the overall role in the department.

- The project manager is also responsible for a specific role or a project.

- When team members report to two different managers, the organization automatically breaks down its structure in a different style.

What Are The Pros Of A Matrix Organizational Structure?

There are different pros and cons of using Matrix organizational structure. It offers flexibility, adaptability, and advantages when matching changing customer needs.

This type of organizational structure helps maintain work efficiency and matches market conditions and strategic goals. By creating cross-functional teams working on different projects, these companies can use the Matrix organizational structure to their advantage.

According to LinkedIn.com,

“One of the main advantages of a matrix structure is that it allows for more flexibility and adaptability to changing customer needs, market conditions, and strategic goals. By creating cross-functional teams that work on specific projects or tasks, a matrix structure can leverage the diverse skills, knowledge, and perspectives of employees from different departments, and foster innovation and creativity.”

The intricacy of the matrix organizational structure is one of its main characteristics. You can see from the above sections that the employees are answerable to two managers – functional and project managers. This is because the allocation of resources is in such a way that the human resources are utilized at their highest.

The following are some of the major pros of a matrix organizational structure:

- The departments are able to coordinate better, as the structure brings highly competent team members from different departments to one place.

- One of the major characteristics of a matrix organizational structure is that it combines the operational and project management frameworks.

- The communication between two or more departments gets better with the implementation of the matrix organizational structure.

What Are The Cons Of A Matrix Organizational Structure?

Like most management structures, the matrix organizational structure also has its drawbacks. Here are some of the cons of the matrix organizational structure that you will need to be aware of:

- There is a continuous need for clarification for the managers regarding their positions, and there are ambiguities in some cases. Hence, there is always a need to define the power dynamics between managers.

- Apart from the managers, the teams also need clarification regarding their roles in the structure. The individual team members should have a good idea of what their role is at the functional level and what their role is at the project level. This helps in reducing miscommunication between the members.

- In some cases, due to the involvement of different teams and departments, the decision-making processes can get a bit longer. Apart from that, time is taken since decisions regarding processes need to be made through two different managers. Hence, processes such as quality assurance slow down due to the presence of multiple supervisors.

Read More: Entrepreneur : Who Coined The Term ‘Entrepreneur’?

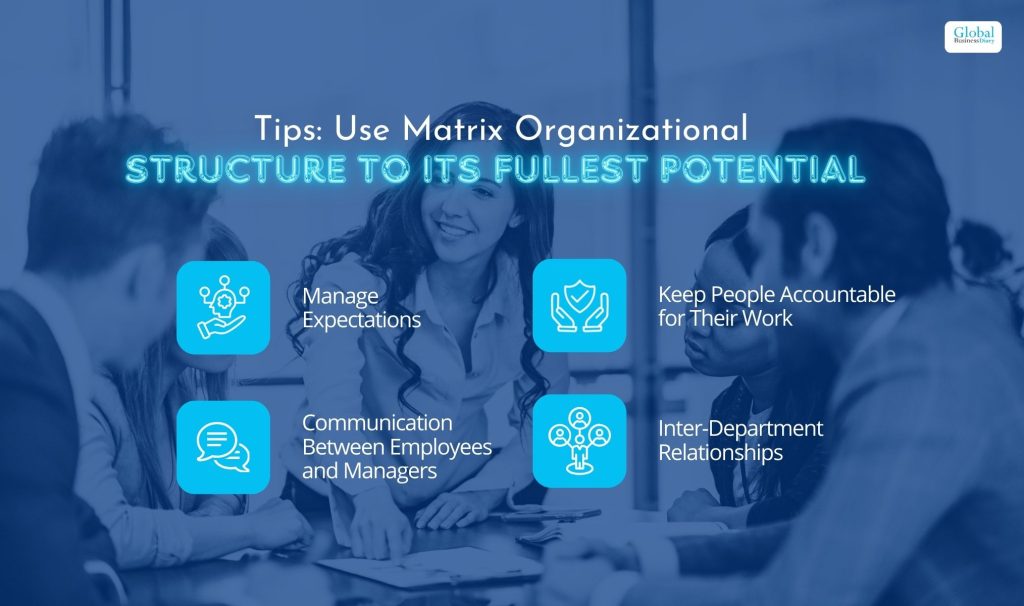

Tips: Use Matrix Organizational Structure to its Fullest Potential

If you are planning to use the Matrix organizational structure, it’s best to start by outlining different roles within the project. Here are several tips to try when utilizing Matrix organization structure in an organization to its fullest potential.

Manage Expectations

While outlining the responsibilities of different roles within the project, the best approach would be to understand the expectations of each manager. A project manager might be expecting the performance of the overall project.

On the other hand, the marketing manager might only be concerned with campaign performance. It’s important to manage the expectations of different managers and work accordingly.

Keep People Accountable for Their Work

The best way to ensure efficient project delivery; it’s important to make people accountable for their work. Workplaces with systems in place to increase engagement in their work can boost accountability. Companies can have a weekly report template for the employees accountable for different tasks.

Communication Between Employees and Managers

It’s important to keep communication seamless and transparent between employees and managers. There can be a weekly chart outlining the completion of tasks. In addition, the managers should also provide employees with feedback. Companies can do it in person or through chat and communication apps used in the organization.

Inter-Department Relationships

Projects requiring co-dependencies from different departments often face operational hurdles. It can happen due to a lack of collaboration and inter-team communication. However, it’s important to deepen interdepartmental relationships to avoid misunderstanding during collaboration.

Wrapping Up

Hope this article was helpful for you in getting a better idea of what a matrix organizational structure is. This structure is best suited for large organizations or organizations that deal with multiple projects. Due to the multiple needs of the organization, the managers can shuffle teams and bring personnel from different departments to work together.

The matrix organizational structure helps in better coordination between departments and ensures a better quality of products and services. Do you have anything to add regarding this type of organizational structure? Share your thoughts and ideas with us in the comments section below.

Read More: