Navi: Information, Eligibility Criteria, Interest Rates, Review & More

You can get Navi personal loan with minimal documentation. Furthermore, if your documentation and your Navi loan application are cleared, you will be able to get the loan even within a few minutes. You can get fast personal loans at 9.9% per annum onwards. This digital instant loan app of Navi gives you fast loans, and also at zero processing fees.

In this article, you will mainly learn about some of the essential features of Navi personal loans. Apart from that, you will also learn about the Navi personal loan interest rates, as well as eligibility criteria, documentation required, and more. Hence, to learn more about the Navi personal loans, read on through to the end of the article.

Navi Personal Loans – A Brief Overview

A personal loan is something that you need to meet any financial requirement if you somehow lack finances at the moment. The loan might be needed to pay your credit card bills, wedding, health expenses, buy something important, and many more reasons. Hence, you need a financial company like Navi to offer you personal loans. Navi is just like personal loan-offering companies like India Lends, CASHe, and others.

Navi, also known as Navi Finserv, offers personal loans up to ₹20 lakhs (INR). The borrower of the loan can get the amount through the Navi app, and also with zero processing fees. Apart from that, the loans are fully paperless and are available after you share your PAN and Aadhar number. Once your documents are verified, and your loan application is cleared, then you can get the loan in as fast as ten minutes.

According to the official website of Navi,

“Navi offers instant personal loans with minimal documentation in a 100% paperless manner. Download the Navi app from Play Store or App Store, apply and get your preferred loan amount disbursed to your account within minutes.”

One of the best things about Navi personal loans is that you will have access to unsecured loans. This means you will not offer any collateral for the loan, nor do you need a guarantor for the loan. Like just any other personal loan option, you will only need to repay the amount you have borrowed in Equated Monthly Instalments or EMIs.

Furthermore, if you want to get returns by investing in mutual funds, you can do that by looking for Navi mutual fund or Navi nifty 50 index fund. In addition to that, there is also Navi health insurance, which you can buy to purchase health insurance plans.

Navi Loan Interest Rate, And Other Loan Highlights

The following are some of the highlights of Navi personal loans that you will need to know about:

| Navi Personal Loan Highlights | |

|---|---|

| Rate of Interest | 9.9% to 45% of the principal amount |

| Available Loan Amount | Loans of up to ₹ 20 lakhs are available |

| Tenure of the Loan | The loan is available for up to 6 years |

| Preclosure fees of the loan | There is no preclosure fee for Navi Loans. (There is no disclosed amount. Contact the lender of the loan to know more.) |

You can see from here that the minimum rate of interest for Navi personal loans is 9.9%. However, the rate of interest can rise to 45% based on a variety of factors. These include – monthly income, age, job profile, loan repayment history, credit score, and many more.

Navi Personal Loan Eligibility Criteria

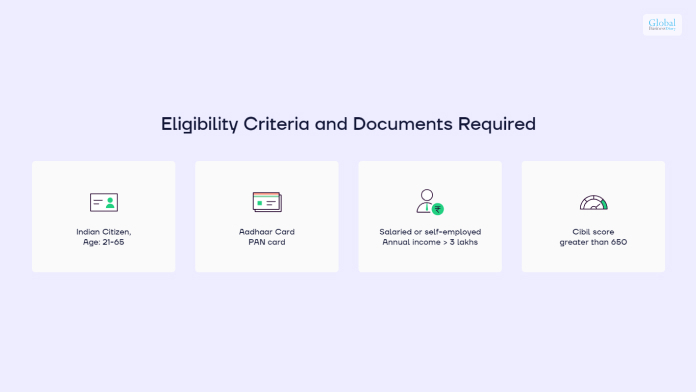

The following are some of the essential eligibility criteria of the Navi personal loan that you need to clear if you want to avail of personal loans:

| Factors | Eligibility |

|---|---|

| Nationality | – Borrower must be a citizen of India |

| Occupation | It must be either of the two:- Salaried- Self-employed |

| Age | – The loan applicant must be aged between 18 to 65 years.- The minimum required age can be increased to 21, 23, or 25 years in special cases. |

| Credit Score | – To avail of the Navi personal loan, a borrower needs to have a minimum credit score of 650 (CIBIL score). |

| Documents Required | – PAN Card- Aadhar Card |

Navi Loan Minimum Salary

Every credit company has a base line salary criterion. But why?

This is mainly to ensure that you can pay back the loan you take.

How is it determined?

A threshold is considered. It is INR 15000 on most occasions. However, there are other factors that decide whether you will get a loan with INR 15000 salary.

Firstly, your creditworthiness matters. You are ineligible if you have an INR 15000 salary with a low credit score.

However, you can get a credit line from Navi if you have a minimum credit score of 650.

A person with credit score of 650 means two things:

- No or minimal credit repayment default cases

- Average credit worthiness, as evaluated by other credit companies earlier

The next threshold salary bar is INR 20000. It implies that your loan value will be greater as well.

However, the banks that grant INR 20000 as the threshold eligible salary for credit, will not consider INR 15000 as threshold.

For instance, IDFC First Bank gives loan against a minimum salary of INR 20000.

But there are no schemes that can get you a loan if you have INR 15000 salary.

Moreover, there are differences in credit worthiness of the two individuals. In simple terms:

- An individual with INR 15000 salary may get up to INR 1500000 as loan.

- An individual with INR 20000 salary may get up to INR 2500000 as loan.

Benefits of taking a navi loan minimum salary

The navi loan minimum salary is INR 15000. But it may be higher if your credit performance is not good. Ideally, you must have a credit score of 650 with a minimum salary of INR 15000.

If you wish to take loan against this threshold criteria, you may get the following benefits:

- No collateral against the credit line/loan that you get.

- The repayment tenure might span up to 5 years.

- You might have to pay slightly more interest, but you may get a favorable EMI breakdown.

- You can get your credit line from Navi, immediately approved.

- You can do KYC and documentation prior to approval online, in minutes.

- If your loan is around INR 15000, it will take almost no time to be disbursed.

- As there are no collaterals, there are no instances of validation, once KYC is done.

- You may get a small credit line against minimum salary, but you can pay back and get a higher credit line.

- No concealed charges are applicable, as you get to know the final repayment value, before you sign the disbursal letter.

Other miscellaneous eligibility criteria applicable

You must have a fixed salary from an acceptable source. However, you can be self-employed as well. For instance, you may run a coaching center. Mostly navi loan minimum salary comes with the criteria of 1-2 years of minimum work experience.

Lastly, navi loan minimum salary is INR 15000, only when you are 23 years of age at the least.

There are no hidden clauses. If you meet the two main criteria (min salary of 15000 and 650 credit score), you will get a loan easily.

How To Apply For Navi Personal Loan? – Steps To Follow

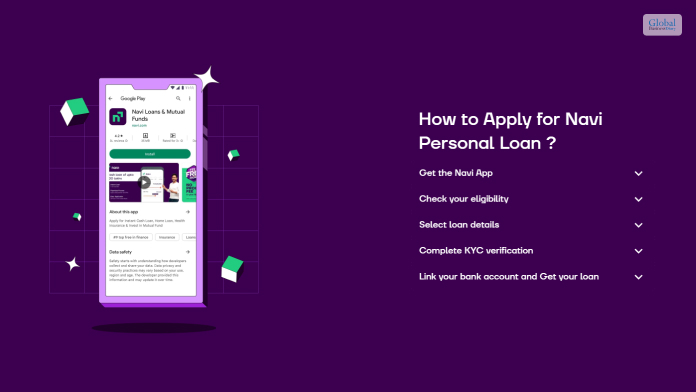

Once you are okay with the essential features associated with Navi personal loans, you will need to apply for a personal loan from the Navi app. Here are the steps you need to follow to apply for a personal loan from Navi:

Step 1:

Go to Play Store or App Store, and download the Navi personal loan app. Install the app on your Android phone or iPhone.

Step 2:

Register your mobile number on the Navi server through your app.

Step 3:

Check the eligibility of the loan, and fill in your personal details through the app.

Step 4:

On the app, go to the next page, and select the loan amount and the EMI amount.

Step 5:

Once you have the amount, you need to complete the KYC process, where you need to produce your Aadhar and PAN numbers and upload a selfie of yourself.

Step 6:

Enter your bank account details which are needed for the transfer of money.

Step 7:

Apply for the loan. Once your loan is verified, you will get your loan fast. The money will be transferred to your amount within the time specified to you.

Is Navi Approved BY RBI?

Now many people ask whether Navi is approved by RBI or not. Then, in this case, the Navi official website claims,

“RBI does not approve digital lending apps. The Navi App is operated by Navi Technologies Limited. Navi Finserv Limited is an RBI registered Systemically Important Non-Deposit Taking NBFC (ND-SI) which lends through the Navi App. Navi Technologies is the digital lending partner of Navi Finserv.”

Frequently Asked Questions!!! (FAQ):

Ans: Navi offers personal loans for attractive interest rates that start from 9.9% with some flexible EMI options upto 72 months. You need to get through the right options that can assist you in attaining your requirements with complete ease.

Ans: NAVI loan is a legit application that offers you health insurance services as per your requirement. You have to get through the complete process that can make things easier for you to attain your requirements with complete clarity.

Ans: Yes!! Navi personal loan is approved by RBI. You have to get through the complete process that can make things easier and effective for your business in the correct order. You should follow the right process that can make things easier for you to get the loan on time.

Ans: If your age bracket is between 18-45 years then you are eligible for the Navi Loans. You have to get through the complete loan process can make things easier for you to get the loans on time. Try to figure out the reasons for getting or not getting the loans.

Ans: You need to be an Indian citizen within a period of 21-65 years. You cannot make your selection and choices in the incorrect end. You need to have 3 lakhs of money as your salary.

Summing Up

Hope this article was helpful for you in getting a comprehensive idea of what to expect from Navi personal loans. If you are looking for a quick personal loan, you can apply for one through the Navi app; however, as you have seen that the rate of interest can change as per the loan amount and the applicant’s details. Do you know of any other app that offers similar loan rates? Share your answers in the comments section below.

Read More: