Upwards Review: Is This India’s Best Instant Loan App?

Getting instant personal loans for paying off dues, medical bills, wedding expenses, smartphone purchases, and more can be a boon to many. Therefore, salaried people in India have started applying for Upwards personal loans to get quick loans without much documentation and requirements!

To learn more about this instant personal loan provider in India, read this post till the end. Here, I have explained what personal loan you can get, along with its eligibility criteria and step-by-step application process.

Upwards: Company Background

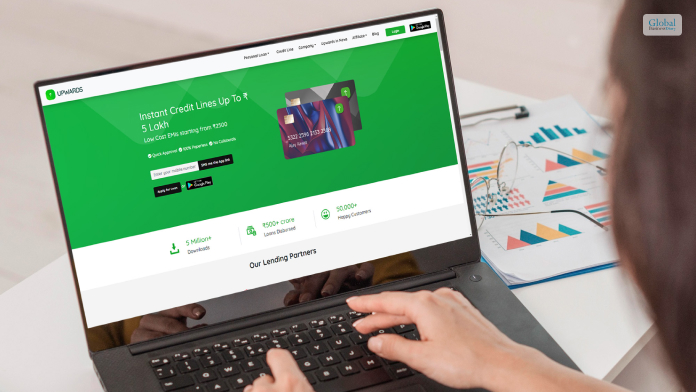

When it comes to getting personal loans in the quickest and simplest way in India, Upwards is the best one. This company was established in 2017 and is a registered loan provider as per the RBI (Reserve Bank of India). Its Instant Loan App became popular in India.

This company got popular in the last few years for providing personal loans to salaried employees. However, the primary reason they became popular was that they provided these loans quickly – within 48 hours after applying for the loan. In some cases, people even got their loans on the same day they applied for it!

Read Also: Create Invoices Online With http://www.zintego.com/.

Upwards Personal Loan: Overview

Providing personal loans to customers is the primary service provided by Upwards. No matter what reason you have for taking a loan, you can get a personal loan instantly using this app. This makes it similar to Fullerton India, and Dhani.

But what is a personal loan?

A personal loan is a type of loan that is unsecured. This means that there is no security against non-payment of loans. Therefore, there is no collateral against the loan that the bank or loan provider can claim in case of failure of payment. Typically, personal loans are short-term loans that also have a lesser amount compared to a secure loan.

In regards to Upwards, they can provide you with personal loans up to INR 2,00,000 (Rs. 2 lakhs). The company also offers personal loans for a repayment period of a maximum of 60 months (5 years).

Regarding the interest rates that you have to pay for your personal loans, they will be based on various factors. These factors are all stated in the Upwards loan eligibility criteria, which I will explain below. The minimum interest rate for this personal loan is 9%.

Key Takeaways

The main highlights of this personal loan are:

- The minimum amount that you can borrow is Rs. 20,000, and the maximum amount that you can borrow is Rs. 2,00,000.

- If you apply for this loan, you will not require any paperwork of any kind.

- The interest rate on this loan is pretty affordable, starting from 9% only!

- This personal loan is free of any collateral.

- No matter what purpose you have, you can use the loan money for anything and everything.

- The approval and disbursal system is instant, happening on the same day as you applied or the next day.

- Applying for this loan is hassle-free since it requires only a few documents. Also, the entire process is online.

- If you get this loan and repay it on time, then your credit score will increase!

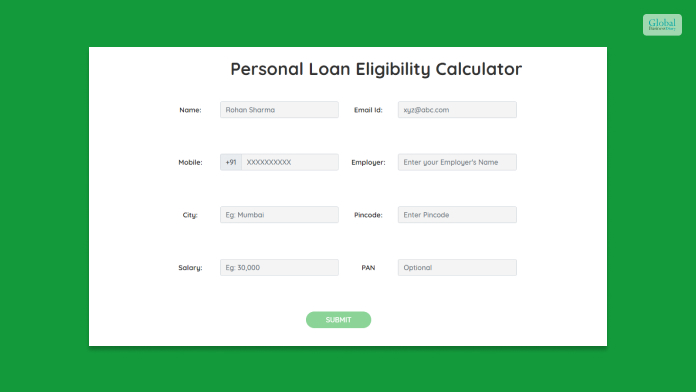

Upwards Personal Loan Eligibility Criteria

If you wish to know whether you are eligible to apply for an Upwards personal loan, then you are in the right place. There are a few eligibility requirements that you must meet before you can apply for a loan, unlike LazyPay. These requirements are:

- You must be a resident of India with all legal certifications to prove your Indian citizenship.

- Regarding your age, you must be at least 21 years of age to apply for an Upwards personal loan.

- You must be under current employment and should have a base salary of INR 20,000 per month.

- When it comes to your credit score, it must be above 600.

How To Apply For Upwards Personal Loan?

If you wish to apply for an Upwards instant personal loan, there is a simple process to follow. In addition, you must also provide some basic necessary certifications.

Documents Required

The documents that you must show before you can apply for a personal loan are:

- Address Proof: Any ID card (like a Voter ID card or Aadhar Card) that can prove your current address.

- PAN Card: Your PAN Card is required for checking your credit score and more as per RBI (Reserved Bank of India) regulations.

- Bank Statement: You must present a printed or digital form of your bank statement to show whether your account is legit or not.

- Salary Payslips: When requested, you must showcase your salary payslip for the last three months as proof of employment.

Application Process

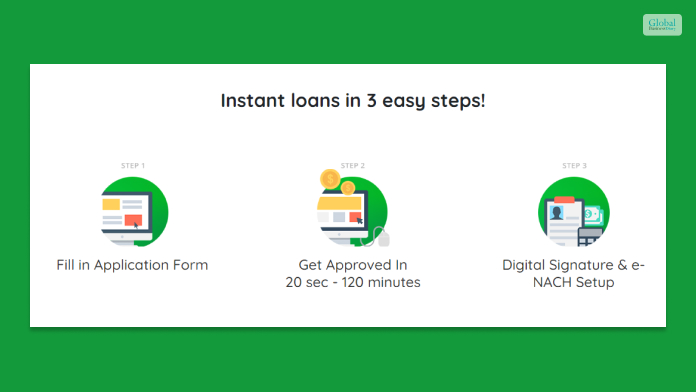

The Upwards personal loan application process is pretty simple and hassle-free. Here are the steps that you need to follow:

- First, you must learn how to manage upwards loans. You can do so through the Upwards app. Download it for free from the PlayStore (Android) and App Store (iPhones).

- Next, you must Upwards login by using your GMail account or Facebook account.

- After you have done so, open the app and click on Apply Now.

- Here, you must upload digital copies of the necessary documents, like your Aadhar Card, PAN Card, salary payslips for the last three months, and your bank statement.

- Now, you must fill in the application form.

- After you have filled out the form, click on the Submit.

After you have filled out the application form and providing all necessary documents, you must wait for approval. You will get an approval mail within the same day if your application gets approved, that is.

If you do get the loan approval mail, you will be contacted by an Upwards executive. You now have to agree on the loan terms online over the phone. After an agreement is reached, you will receive your personal loan money within 48 hours!

If you do not receive the money, then you must contact Upwards customer care immediately.

Benefits Of Upward Personal Loan

There are several benefits of the Upward personal loan. It can help you in different means. You must know the facts perfectly while attaining your objectives with complete ease. Ensure that you follow the correct process in this regard. Some of its key benefits are as follows:-

1. Structured Repayment Option

Upward personal loans typically come with fixed monthly payments over a set period, making it easier to budget and plan for payments. You need to get through the complete process that can make things easier for you in attaining your requirements with ease.

2. Offers Flexible Loan Amounts

Borrowers can often access a range of loan amounts, allowing them to borrow what they need based on their financial requirements. The flexible loan can sort out your financial needs when you require it the most. Once you follow this process, things can become easier for you.

3. Predictable Interest Rates

These loans commonly have fixed interest rates, providing predictability in monthly payments throughout the loan term, even if market rates change. You must get through the predictable interest rates that can boost your brand value to the next level.

4. Builds The Credit History

Consistent, on-time payments on an upward personal loan can positively impact credit scores, contributing to an improved credit history. Once you have a trusted credit history things can become easier for you to get the loans on time.

5. Quick Access To Funds

Depending on the lender, approval and funding for upward personal loans can be relatively quick, allowing borrowers to address financial needs promptly. You will get quick access to the funds to make things happen in your favor.

6. Variety Of Uses

These loans can be used for various purposes, such as debt consolidation, home improvements, major purchases, or unexpected expenses, providing flexibility in how the funds are utilized. The loan amount you can use for a variety of purposes. Remember that while upward personal loans offer numerous benefits, borrowers should carefully assess their financial situation and ability to repay before taking on any loan. Understanding the terms, fees, and potential impact on credit is essential in making informed borrowing decisions.

Conclusion: Is Upwards Legit?

If you think Upwards is fake, then you are wrong. This company is 100% legit. However, the only difference you will find is the time taken to receive your personal loans. While the Upwards website claims that you can get your loans in the same day, it actually takes more time than that.

Read Also: