CASHe Personal Loan App: Information, Eligibility Criteria, Interest Rates, Review & More

Are you looking for a quick personal loan? Then CASHe is a great option for you, where you will be able to get short-term loans at low-interest rates. This platform is specifically created to offer short-term loans to young-salaried and self-employed people. The loans are of instant disbursal. You can get personal loans, even if you do not have a credit history.

In this article, you will basically learn more about CASHe loans and the major features of the CASHe app. Furthermore, we will also share some of the major reviews of CASHe, which can be beneficial for you to get an idea of the platform in general.

CASHe – How Does It Work?

CASHe is a personal loan app that uses a credit scoring mechanism called Social Loan Quotient, which is based on artificial intelligence. In this mechanism, the CASHe app leverages various alternative sources of data coming from smartphones, social media and others.

Furthermore, monthly salary, education, career experience, and basic KYC experiences. This is mainly done to evaluate a loan borrower’s worthiness of credit.

CASHe App: How To Download The CASHe Loan App?

The following are the steps that you need to follow to download the CASHe app:

Step 1: Go to Google Play Store on your smartphone.

Step 2: Type ” CASHe ” on the search bar and tap on the search button.

Step 3: Click on the app named ” CASHe”

Step 4: Download and install the app.

You can also use the CASHe promo code to get good offers on loans, as well as various graces on the rate of interest. Apart from the app, you can also visit the CASHe official website to see various details of the loan. If you want to get yourself a loan, go to the instant personal loan section, and click on the “Get a Loan” button.

You will need to fill up a form and choose the type of loan you need. Furthermore, you will need to upload scanned documents about your personal details. After all these documents get properly verified, you will get the loan in no time. You can also get the loan within the same day.

CASHe Loan Details

| CASHe Personal Loan Details | |

| CASHe Interest Rate | 2.25% |

| Loan Amount | ₹1000 to ₹4 lakh |

| Loan Tenure | 3 months to 18 months |

| Minimum Age of Loan | 18 years |

| Loan Processing Fee | Up to 3% of the loan amount |

| Minimum Income (Monthly) | ₹12000 |

| CASHe Loan Website | https://www.cashe.co.in/instant-personal-loan/ |

| CASHe Complaints number | Not available on the website |

The CASHe interest rates range from 2.25% per month to 2.5% per month (or 27% per annum to 33% per annum), based on the repayment tenure that you have chosen in terms of your loan. Once you have chosen your loan type, you will only need to pay accordingly.

What Are The Eligibility Criteria To Get CASHe Personal Loans?

Here are the eligibility criteria you will need to fulfill to get an instant personal loan from CASHe:

- You need to be at least 18 years of age. Minors are not eligible to get loans from CASHe.

- Your maximum age should not be more than 58 years.

- You must be at least employed for three months in your current organization where you are employed.

- You should be able to provide valid income proof. Your monthly income should be at least ₹12000 per month.

- You can only get a loan where the loan to value is 30% to 200% of your monthly salary. However, it depends on the type of loan that you choose.

- You can make use of the cashe promo code to get the loans on time.

What Are The Documents Required For Loan Application?

There are several types of documents that are required for the loan application of the Cashe Loan. You must have the following documents with you that you should make use of the Cashe Loan documents while making the application of personal loan.

- Photo Identity Proof as well as PAN card.

- You have to show your latest salary slip and income proof.

- You must use the Aadhar Card or any identity proof.

- Permanent Address proof you have to show to get the loan.

- You need to show up the latest bank statement where your salary is credited.

You need to be well aware of these above factors while you want to get the things done in perfect order. You should take care of the facts that can make things easier and effective for you in all possible manners.

Types Of Personal Loans Available At CASHe

There are various types of personal loans that you will be able to get through CASHe. Different types of loans include car loans, two-wheeler loans, medical loans, education loans, consumer loans, mobile loans, travel loans, and marriage loans. The following are the major types of personal loans options that you will be able to get through the CASHe app:

CASHe 180

| Tenure of the Loan | 6 months |

| Minimum Salary required to be eligible | INR ₹22,000 |

| Minimum loan amount | INR ₹25,000 |

| Maximum loan amount | INR ₹2,10,000 |

CASHe 270

| Tenure of the Loan | 9 months |

| Minimum Salary required to be eligible | INR ₹25,000 |

| Minimum loan amount | INR ₹50,000 |

| Maximum loan amount | INR ₹2,58,000 |

CASHe 1 Year (360 Days)

| Tenure of the Loan | 12 months |

| Minimum Salary required to be eligible | INR ₹40,000 |

| Minimum loan amount | INR ₹75,000 |

| Maximum loan amount | INR ₹3,00,000 |

CASHe 1.5 Year (540 Days)

| Tenure of the Loan | 18 months |

| Minimum Salary required to be eligible | INR ₹50,000 |

| Minimum loan amount | INR ₹1,25,000 |

| Maximum loan amount | INR ₹4,00,000 |

Other Types Of Personal Cashe Loans Availaible Today

There are different types of cashe Loans available today that you must be well aware off. You cannot just make your choices in gray. You need to follow some of the essential facts that can make use of the Personal Cashe loans available for you in all possible manner. Some of the key factors that you must be well aware of are as follows:-

- Instant personal loan.

- Travel loan .

- Two-wheeler loan.

- Mobile loan.

- Marriage loan.

- Home renovation loan.

- Education loan.

- Consumer durable loan.

- Car loan.

- Medical Loan

You can make use of the Cashe Promo code to get some discounts on these mentioned above loans. You must make things work as per your requirements. It will help you to get the desired loans on time. Explore the best loan options that fits your budget and requirements. Otherwise, things can turn worse for you. Cashe offers personal loan based on the loan tenure within a particular point in time.

The details of getting the loans and its procedures you can get from their sites of paisabazaar.com. It will offer you all the complete details how you can afford these types of loans as you need.

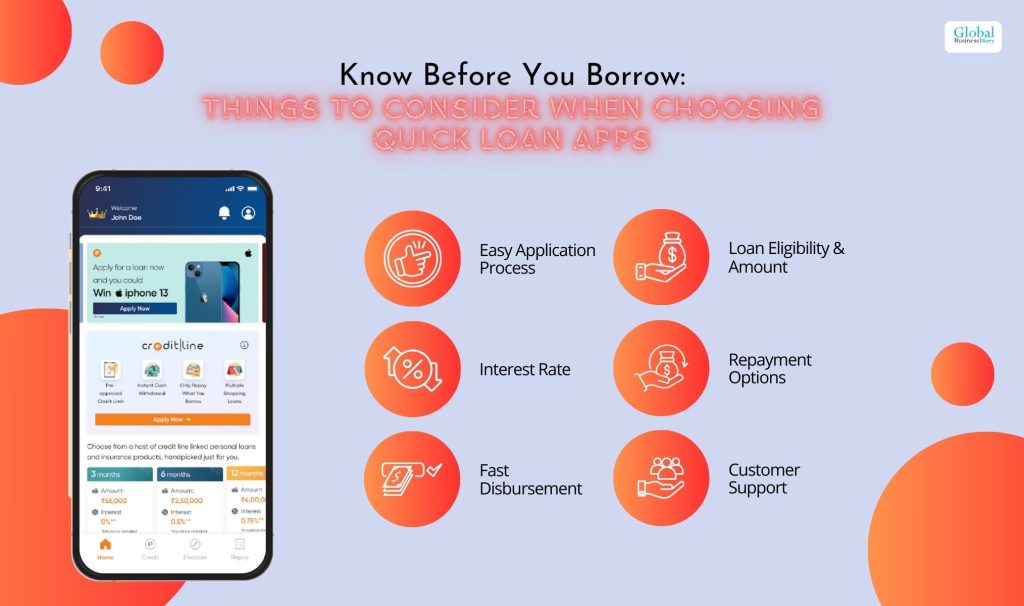

Know Before You Borrow: Things to Consider When Choosing Quick Loan Apps

Read about the factors that are considered when it comes to choosing the right app! If you plan to choose a quick loan app, you must check a few things first. It starts with the following factors:

Easy Application Process

When choosing an instant loan app, ensure the application process is simple and easy. The entire process has to be straightforward and user-friendly.

Always avoid apps with complex application procedures and require too much paperwork. You should be able to complete your application process straight from the smartphone.

Loan Eligibility & Amount

Some of the apps are designed for professionals. On the other hand, when choosing an app, ensure it doesn’t put high bars for loan approvals.

For example, many loan apps require a significantly maintained credit score. Some apps require a good credit score, age limit, etc.

Interest Rate

Always ensure you get a good interest rate when taking a loan from an instant loan platform. The interest rate decides the overall amount you have to repay throughout the entire lifecycle of your instant loan. Typical

Repayment Options

It’s best to have a flexible repayment option. The repayment option should suit your financial situation. While some of these instant loan providers offer shorter repayment options, others also offer a long tenure.

If you want flexibility with your loan repayments, you should go for providers that allow an extension on your repayment.

Fast Disbursement

Instant loans are all about your loan getting disbursed as soon as possible. But that’s not always the case. Some instant loan providers often take a long time to disburse the loan amount.

So, when choosing personal loans, ensure you’re getting it from a reliable platform that disburses the loan right after approval. When approved the money should get credited to your account.

Customer Support

In case you are struggling to get the loan approved or want assistance regarding repayment tenures and flexibility, there should be a customer support team helping you.

Whether during your repayment tentures or during application, the customer support team of the loan platform should help you. So, always choose a platform with a reliable customer support team.

CASHe 1.5 Year (540 Days) Reviews – CASHe Review, CASHe Loan Review, And CASHe App Review

Let us go through the reviews that are significant in understanding the apps where you can get a loan. Here are some of the major CASHe loan reviews that you must look for:

Review 1:

Review 2:

Review 3:

Summing Up

One of the things we do not like about CASHe is that there is no CASHe loan customer care number for any types of CASHe complaint. Here, the safety factor goes away completely. However, the reviews for the loan platform are mixed. So, check your loans properly, before you get a personal loan. Share with us in the comments section what you think about CASHe.

Read Also: