Fullerton India Review: Things To Know Before Taking A Loan!

Nowadays, if you are in need of money, whether it’s for personal uses or for your business, getting it instantly is a major convenience. Therefore, many new loan institutions are cropping up globally. One such company from India that I am going to discuss is Fullerton India Ltd.

To learn more about this Kolkata-based company, read this post till the end!

Fullerton India: Company Overview

Fullerton India credit company Ltd is a new finance company originating from Kolkata, India. With its headquarters in Park Street, they have managed to gain a lot of traction lately by providing instant loans to people and businesses.

One of the primary reasons they have become popular is because of how easy it is to get approved loans from Fullerton. Plus, their loan application processes are easy – you can do them entirely online if you wish to! In addition, you don’t need a Fullerton India credit company limited account!

Fullerton is similar to other Indian financial institutions like Navi, PayMe India, and LoanTap.

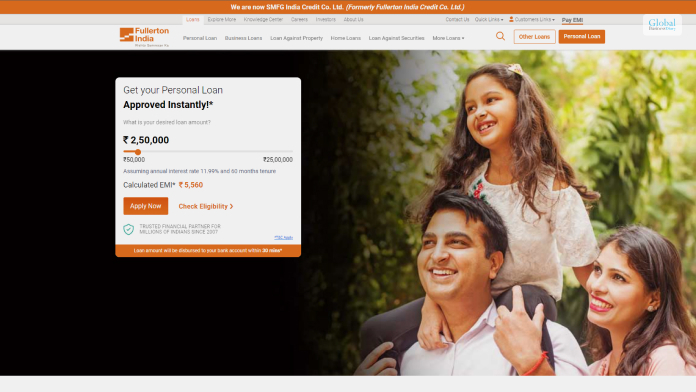

Fullerton India Personal Loans

Fullerton India is widely renowned for providing personal loans to account holders at lower-than-average interest rates. As long as you are eligible for Fullerton India personal loans and you are a salaried employee, you will get such loans quickly.

All the procedures of this company are completely transparent to ensure that there are no hidden charges or secret terms and conditions in place. In addition, most of the Fullerton loan payment solutions can be customized by you to an extent.

| Maximum Loan Amount | Upto INR 25,00,000 |

| Repayment Tenure | Minimum 12 months, maximum 60 months |

| Interest Rate | Starting from 17% |

| Processing Fees | Upto 6% of the total loan amount |

| Prepayment Charges | Upto 7% of the total loan amount |

Why Should You Apply For Fullerton India Personal Loan?

Some of the benefits of applying for a Fullerton India personal loan are:

- The application process for this loan is 100% digital – no paperwork is required.

These personal loans are free of any collateral. - Repayment tenures for these personal loans are flexible.

- Since these are personal loans, the reasons for applying for this loan can be anything.

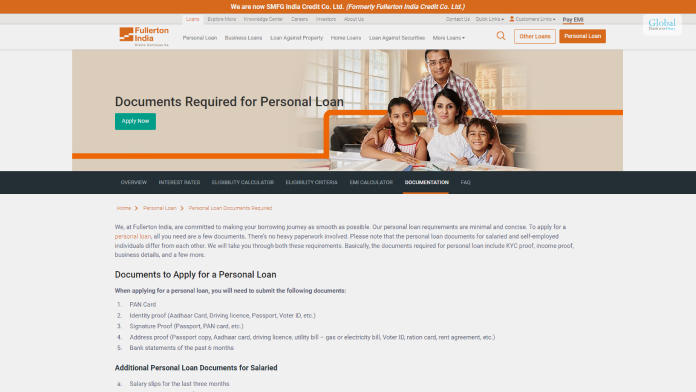

Required Documents

To apply for this loan, you need the following documents:

- A filled application form that is also digitally signed.

- Identity proof (should contain proof of your address, age, and citizenship)

- Salary Pay Slips for the last three months

- Bank statement for the last six months

- Form 16 Income Tax Returns report

- Other necessary financial statements and Proof of income (if you are self-employed)

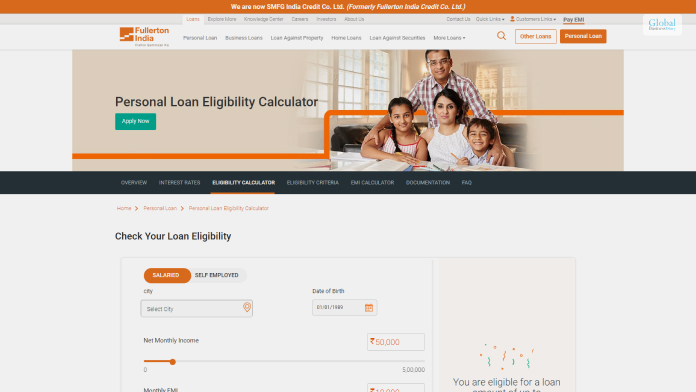

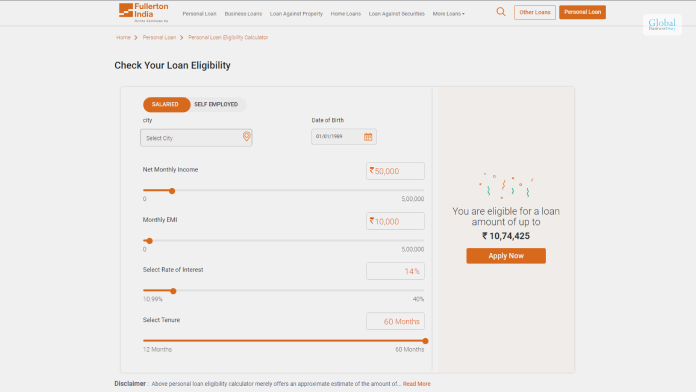

Personal Loan Eligibility Criteria

You will be eligible for Fullerton India personal loans by meeting these requirements:

| Age | Minimum 21, maximum 60 |

| Employment Status | Must be salaried or self-employed |

| Minimum Income | Minimum salary INR 25,000 |

| Credit Score | 750+ CIBIL score with a good credit history |

| Nationality | Indian |

| Work Experience | Minimum 1 year of work experience |

Fullerton India Business Loans

If you are an entrepreneur and you are in need of funds to expand your business, then contact Fullerton India. They have business loans for all types of businesses, both big and small.

Not only will these loans help you manage your business capital necessities, but they will also help you manage your capital needs for other purposes. This includes inventory purchases, workspace expansion, marketing, and any other additional payments.

| Maximum Loan Amount | Upto INR 50,00,000 |

| Repayment Tenure | Minimum 12 months, maximum 60 months |

| Interest Rate | Starting from 11.99% |

| Processing Fees | N/A |

| Prepayment Charges | N/A |

Why Should You Apply For Fullerton India Business Loan?

The primary benefits of applying for loans from Fullerton India home finance company limited are:

- All the loan facilities provided by the company are flexible since you have a loan repayment tenure of upto 48 months.

- Such business loans of upto INR 50 lakhs will be provided to you quickly within 24 hours after you apply.

- There are no collaterals for Fullerton business loans.

- You can access your loan account online pretty easily.

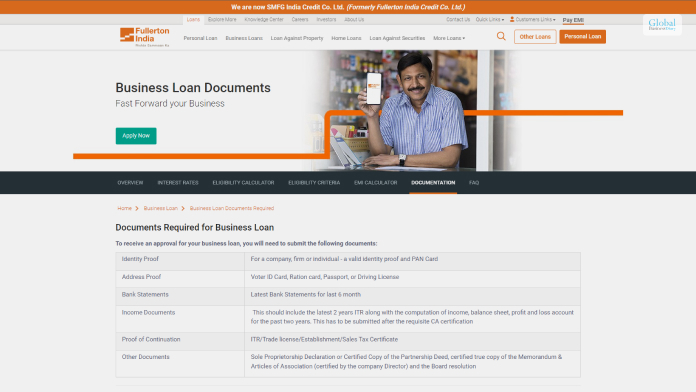

Required Documents

To apply for this loan, you will need these documents:

- A recently clicked photograph of you.

- Identity proof, like your PAN card.

- Address proof like your passport.

- Necessary bank statements

- Income Tax Report (ITR) files or GST Reports

- Income proof

- Business existence proof (like your business’s Certificate of Existence)

Business Loan Eligibility Criteria

You and your business will be eligible for these loans if you meet these requirements:

| Age | Minimum 25, maximum 65 |

| Business Status | Sole proprietorship or partnership |

| Minimum Turnover | Minimum INR 10,00,000 per annum, with INR 2,00,000 profit |

| Credit Score | 750+ CIBIL score with a good credit history |

| Nationality | Indian |

| Business Experience | Minimum 3 years of business life with profits in the last two years |

Other Types Of Fullerton India Loans

Apart from the two loans described above, which are the specialty of Fullerton India, they also provide other customizable loans like:

- Loan Against Property: If you have an immediate expense to clear out as soon as possible, then you can get a loan against your property as collateral instantly!

- Two-Wheeler Loans: These are short-term loans for purchasing your first two-wheeler!

- Home Loans: If you wish to purchase that dream house you have been eyeing for some time, you can apply for this loan!

- Commercial Vehicle Loans: If your business needs a commercial vehicle like trucks and other vehicles, you can apply for this loan!

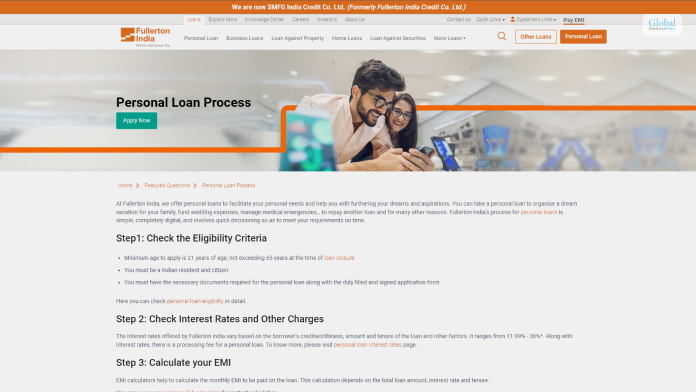

How To Apply For Fullerton India Loans?

If you wish to apply for a Fullerton India loan, you have to follow a simple process, which I have described below:

- First, go to the Fullerton India official website.

- Here, click on the Apply Now button at the top of the page.

- Now, out of all the loan options, select the type of loan you wish to apply for.

- Depending on the type of loan you have chosen to apply for, an application form will open on your screen. Fill it up with all the required details.

- After you have filled up the application form, click on Next.

- An OTP will be sent to your registered email ID and phone number. Confirm them by following the on-screen procedures.

- Now, you must upload scanned copies of the necessary paper documents.

- After you are done uploading scanned copies, click on Submit.

After you hit the final Submit button, Fullerton India will get back to you if your loan is approved in the next 24 hours.

Conclusion

Fullerton India provides loans to people who are in dire need of them. All you need to do is meet their eligibility criteria and apply for their loans online! Plus, they provide many loans like personal loans, business loans, loans against property, two-wheeler loans, commercial vehicle loans, and home loans to apply for!

If you have any queries, please comment below!

Read Also: